UK Proptech Companies On The Rise

Category: Uncategorized

Property and technology are not sectors that have traditionally gone hand-in-hand – indeed, bricks and mortar had previously seemed immune to the innovation the UK has seen in transport, business, communications, and almost every other sphere of human life. That was before the emergence of proptech startups.

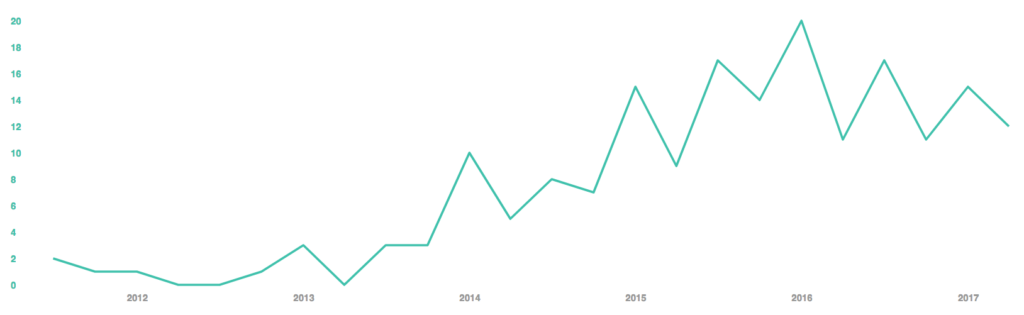

With house prices rising year-on-year, and successive governments’ reluctance to tackle the UK’s extensive planning regulation, it is no surprise that innovation has at last seeped into the UK’s property market. Approximately four years ago, investment trends in property started to change.

Deal numbers into proptech over time

As deal numbers have increased, companies ranging from online-only mortgage brokers to app-based estate agents have blossomed. So which startups are making a name for themselves, and which funds are profiting from their success?

The proptech startups

At the top of the pile is LendInvest, a peer-to-peer lending network designed exclusively for mortgages. Having secured £79m over three fundraisings, and being valued at £128m in March 2016, LendInvest recently made headlines for achieving the highest possible rating for the quality of its loan servicing from ARC Ratings, a European agency.

Following LendInvest is Student.com, having raised £41m in a single round last February. Its platform allows students or young people travelling abroad to find accommodation, arrange any necessary contracts for it, and pay rent once agreements have been made.

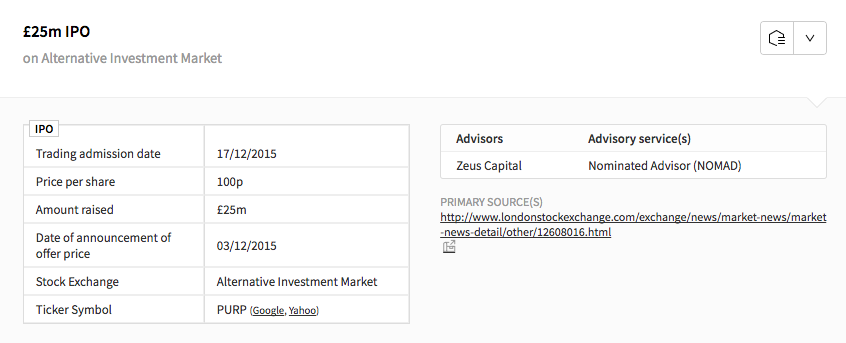

Finally, Purplebricks (formerly New Broom) has raised £32.3m over a total of five rounds. The company has now exited, IPOing with a market cap of £240m at the end of 2015. Beauhurst calculated its value as £135m a month previously – although this figure ought to be treated with caution due to the company’s complex share structure. Purplebricks has developed an online marketplace for individuals who want to sell or let properties, and offers estate agency services at a fixed fee.

The funds

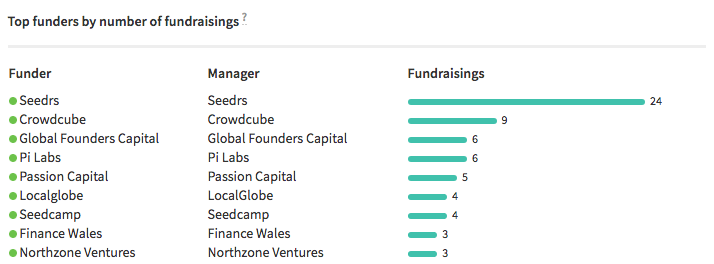

Crowdfunders are at the top of the market when it comes to proptech, with Seedrs leading the way: it has invested in proptech companies 24 times to Crowdcube’s 9. After the crowd are institutional investors Global Founders Capital, Pi Labs, and Passion Capital, having invested 9, 6, and 6 times respectively.

Crowdfunders are typically very active in B2C sectors, but the scale of Seedrs’ dominance is unusual and suggests a good deal of consumer interest in proptech. 67% of the growing companies were at their seed stage at the time of investment, with 56% still there – key signals that the sector is young and ready for growth. The startup death rate, of 5%, is low, and 5% of companies have exited so far. With growth on the horizon, the latter proportion looks set to increase in the near future.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.