New growth in life sciences as other sectors slump

Category: Uncategorized

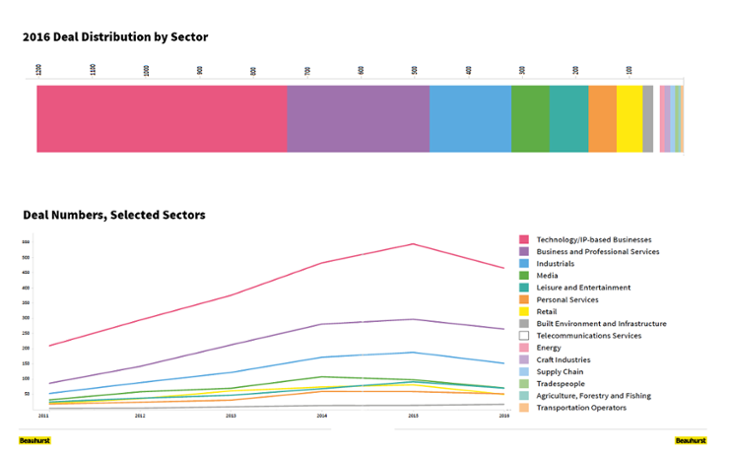

In 2016, investment into high-growth UK companies dropped by 18% across the board. Most sectors saw a decline in both deal numbers and amount invested. But not all sectors suffered equally.

The most significant drops in deal numbers over 2016 were seen for retail and supply chain businesses, where they fell by 39% and 52% respectively, and amount invested fell by 34% and 18%. Meanwhile, built environment and infrastructure deal numbers bucked the trend with a 25% increase.

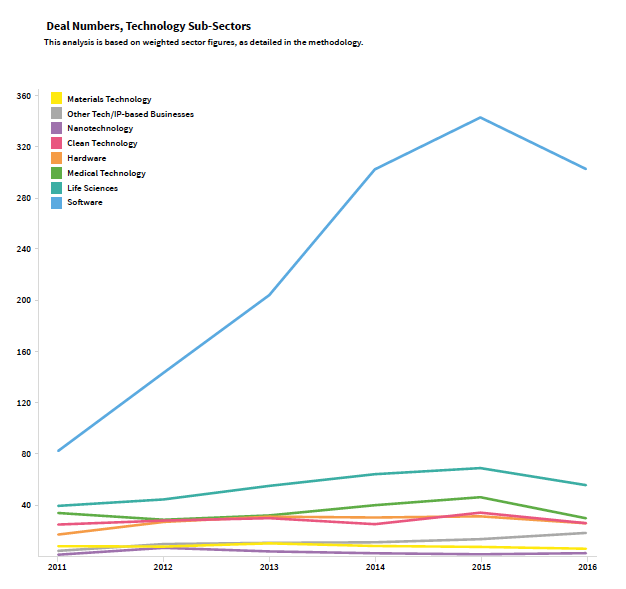

The most interesting data, however, comes from the technology sector. Despite falling deal numbers, 2016 was a good year for life sciences, with some high-profile investments and an upsurge in both deals and amount invested for seed-stage businesses. In fact, seed-stage companies in this sector saw a 19% increase in deals.

Those high-profile investments included $100m (£81m) for Kymab, a pharmaceuticals company based in the East of England. Kymab is developing human antibodies inside living mice, which we blogged about here, and last year raised a total of almost £110m, through two equity fundraisings and one £9m grant from the Bill & Melinda Gates foundation.

The largest fundraising in the sector, however, was secured by Oxford Nanopore Technologies, which has developed a small device that performs DNA sequencing and analysis. The firm raised £100m in its sole funding round last year, and its valuation in mid-2015 was just shy of £1bn.

A final mention goes to Mission Therapeutics, which secured £60m in 2016. Mission Therapeutics is developing drugs which inhibit the proliferation of tumour cells by attacking their enzymes. Its myriad backers include Touchstone Innovations, Roche Venture Fund , Sofinnova Partners, Pfizer Venture Investments , Woodford Patient Capital Trust , and SR One. Indeed, Woodford Patient Capital Trust has invested in all three companies under discussion.

The amount invested in early-stage life sciences companies in the UK has grown continuously, and in 2016 increased by a staggering 182% to £202m. With such promising investment in seed-stage companies, and such large funding rounds being secured by later-stage businesses, the sector is certainly one to watch in the months and years ahead.

This data was originally published in The Deal, Beauhurst’s quarterly report into investment secured by high-growth UK companies. Get the full report here for free.