Inward investment trends in every UK region 2020

Category: Uncategorized

Whilst most of the UK’s 802 active funds reside in the Capital, many crop up in the regions too. Some will focus on a particular location, whilst others will invest wherever they find an exciting and high potential opportunity. When funds invest in businesses outside of the area they’re located in, they undertake what is known as an inward investment; these lasting relationships between investors and investees can support economic development of the recipient companies’ region.

In this post, we explore the types of investment going into each region, whether that be from funds in the same region, funds in different UK regions, or foreign investors.

Inward investment is the deployment of capital into a region from an external source, to help fuel the economic growth. This encompasses foreign direct investment, as well as funding from firms based in different regions in the same country.

- If a deal includes participation from a foreign fund it will be listed as a ‘foreign investment’ or ‘based abroad’.

- if a deal includes UK funds from outside of the recipient company’s region it will be listed as ‘inward investment’ or ‘different UK region to company’.

- If none of the investors in the round are known, and therefore don’t have a known location, the round has been excluded from the analysis.

- In all other cases, the investment is marked as ‘funding from the same region’.

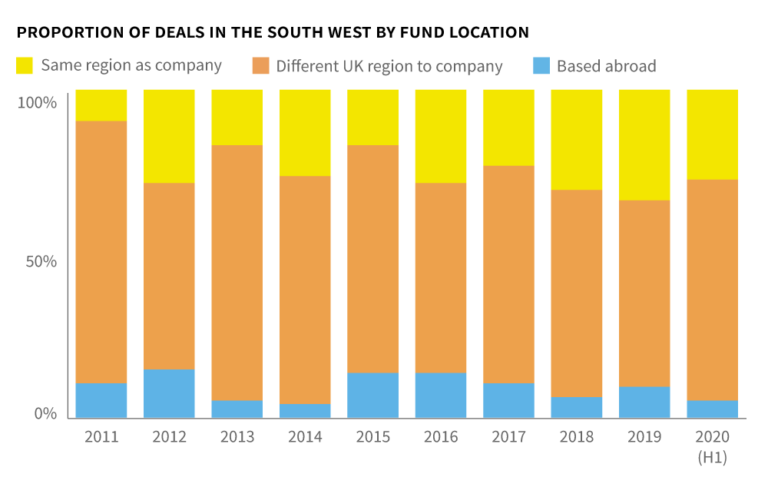

Inward investment in the South West

The South West is the only region to have seen a record number of deals in H1 2020, with 47 investments closed. Since 2011, the proportion of deals completed without investment from other regions or countries has been steadily increasing. Of those that do involve participation from funds in other regions, the vast majority (92%) are London-based.

The majority of investment activity in the South West is focussed on Bristol and its surrounding local authorities. The city has a number of success stories, including clean energy giant OVO Energy, AR pioneer Ultraleap and AI specialist Graphcore.

Graphcore raised the largest funding round so far this year, worth £116m. Completed in February, the growth-stage funding round was backed by a number of British funds, as well as Belgian investor Sofina.

The South West is home to 33 funds, including crowdfunding platform Crowdcube. This is one of the most active funds in the UK, facilitating hundreds of investments across the country each year.

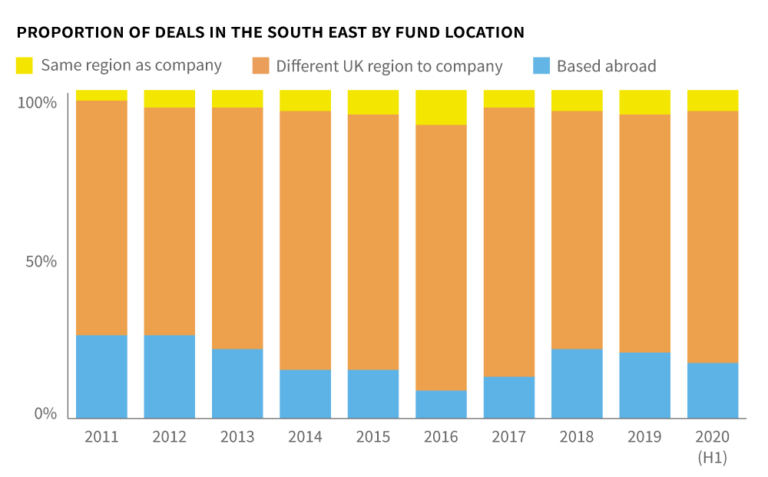

Inward investment in the South East

The South East has one of the highest levels of inward investment of all UK regions. The area is home to startup hotspots Oxford and Brighton, where there is a dense population of highly innovative companies. The South East also benefits from its proximity to London, where most of the UK’s VC firms are based.

The South East is home to 37 active funds, many of which focus their deal activity in the same region. These funds often co-invest with investors from other regions and countries, who are particularly interested in Oxford University spinout companies. As such, the proportion of deals that are completed solely by funds in the same region is fairly low.

The biggest deal secured in the South East so far this year was by clean energy company Tokamak Energy. The round was worth £67m and included participation from various business angels and undisclosed investors. To date, the company has secured 10 funding rounds totalling £123m, with participation from Legal and General, Oxford Innovation and Midven.

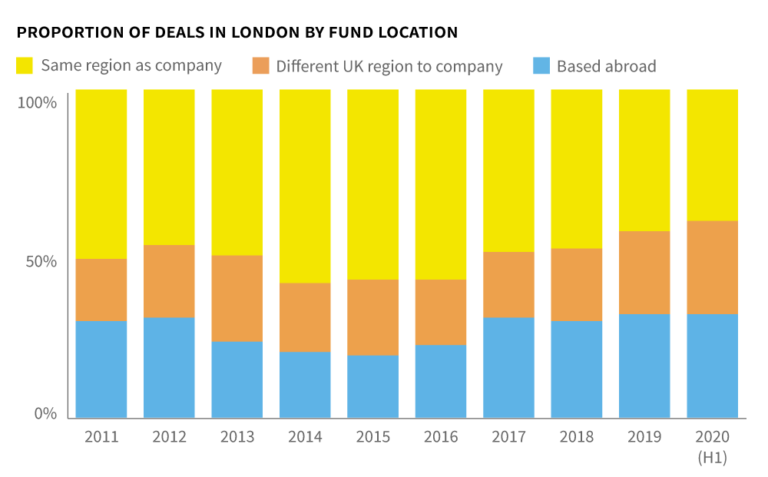

Inward investment in London

With so many funds based in the Capital, and so many innovative companies attracting attention from global investors, it’s no surprise that investment is fairly evenly split between funds from inside and outside the city. The most inward investment comes from the South West (59%) and East of England (19%).

London-based companies secured 50% of all announced UK equity deals in H1 2020, accounting for 72% of all pounds raised. The largest round was worth £383m, secured by challenger bank Revolut. The multi-national round closed in early February and included participation from Russian Digital Sky Technologies, London-based fund Sprints Capital, and American firms Ribbit Capital and Technology Crossover Ventures.

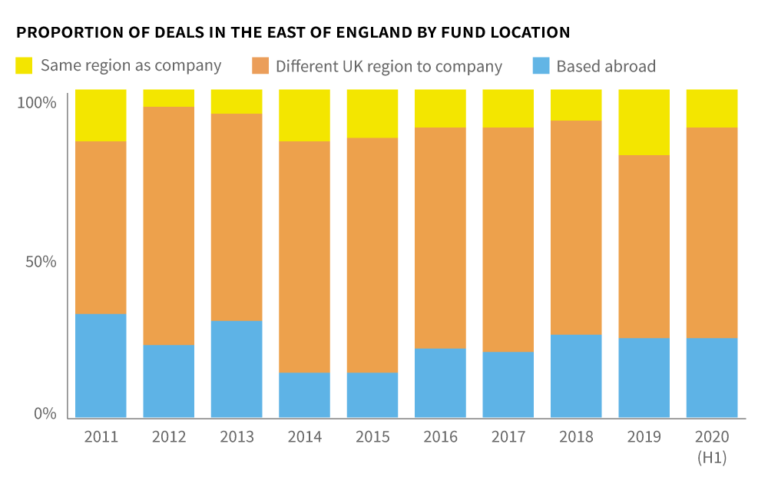

Inward investment in the East of England

The hub of life sciences and deeptech companies in and around Cambridge, many of them spinouts from the university, is a major attraction for investors from all over the world. As such, the region has a consistently high level of inward investment activity from foreign investors, as well as funds from across the UK.

Based in Cambridge Science Park, four-year-old Cerevance secured the largest deal of the half, worth just over £36m. The company develops software and new therapies to help in the discovery and treatment of nervous system diseases. The round included backing from Camden-based Dementia Discovery Fund (DDF), as well as numerous American funds: Foresite Capital, GV (Google Ventures), Lightstone Ventures and Takeda Ventures.

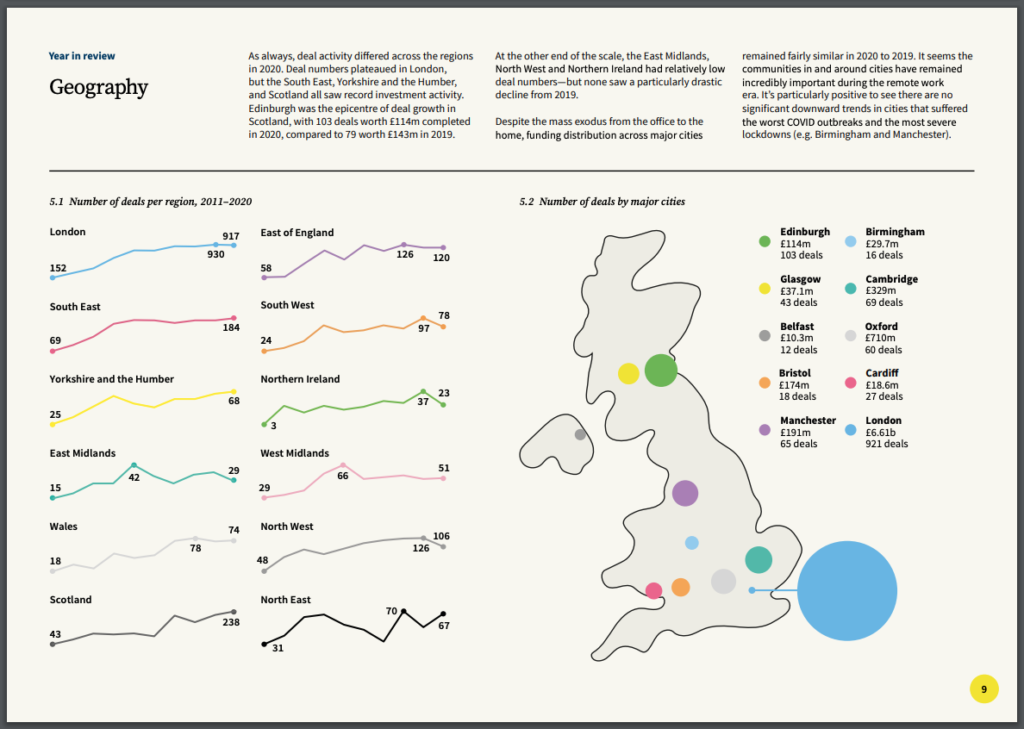

See how much investment each region attracted in 2020

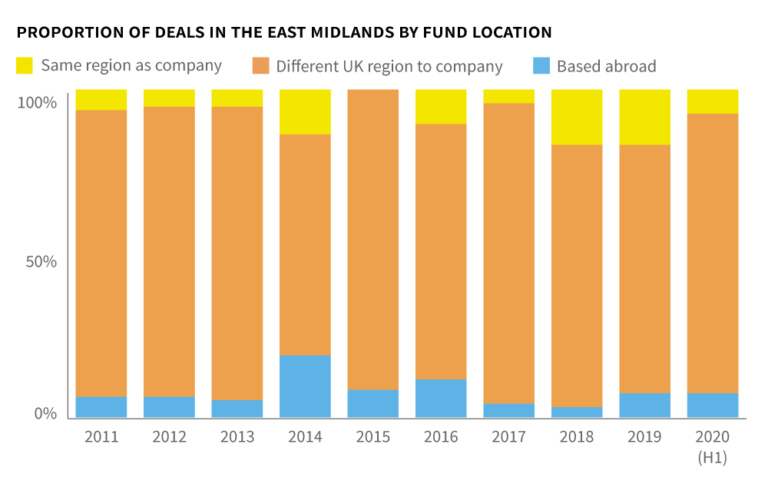

Inward investment in the East Midlands

The East Midlands is one of the worst-performing regions in terms of securing equity investment. Just 16 deals were announced by companies based in the region during the first of the year, down from a high of 23 in H2 2015. Of those deals that are completed, the majority are funded by investors from other regions, particularly London and the South West. This comes as little surprise, as Exeter-based Crowdcube is the most frequent investor in the region.

The largest recipient of an announced investment so far this year was James and James Fulfilment. The Northampton-based company develops software for e-commerce businesses, including order tracking and data reports. The £11m round took place in early March and was funded entirely by Lloyds Development Capital, a fund based in Aberdeen.

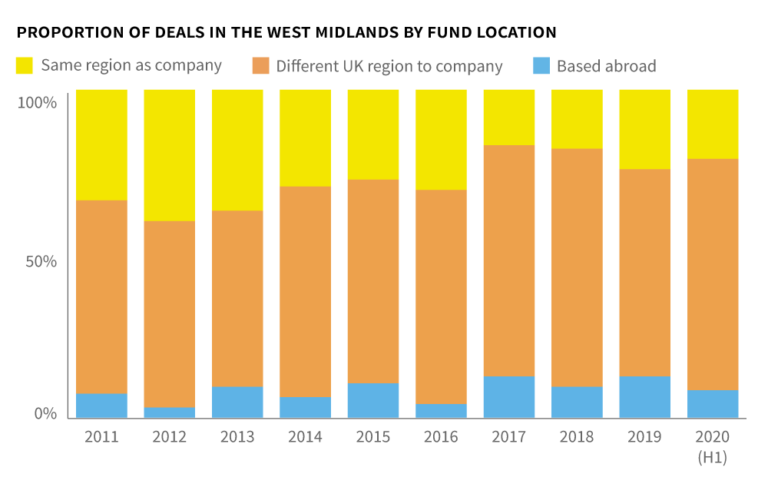

Inward investment in the West Midlands

Investment into the west midlands is fairly steady since 2014. The region has also seen a steady rise in inward investment since 2012, with particular attention in and around Birmingham. In the first half of this year, companies in the West Midlands secured 25 deals, compared to just 21 deals in H2 2019. The biggest recipient was Solihull-based property developer, Hayfield Homes. The company secured an £85m round in January, £50m of which came in the form of a loan from OakNorth Business Loans. Other investors remain undisclosed.

28 funds reside in the West Midlands, the most active of which is Mercia Fund Managers. The firm is based in Stratford-Upon-Avon and invests exclusively in EIS and SEIS-qualifying companies. Aside from London, most investments from other regions come from the South West.

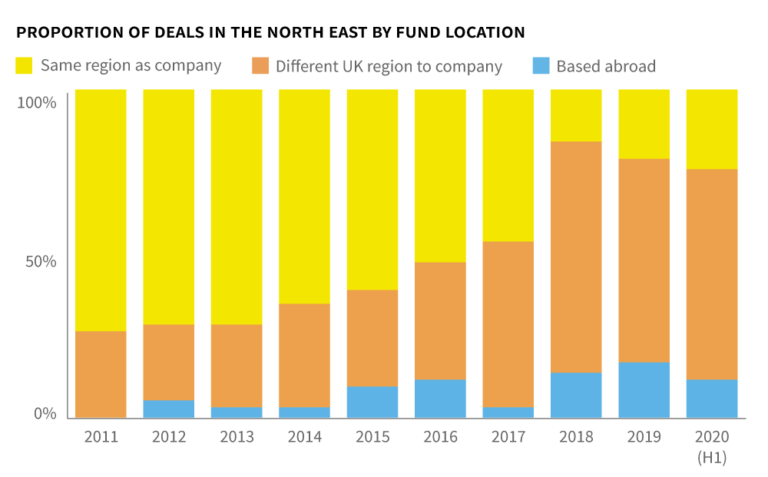

Inward investment in the North East

The North East was the only region to have secured a notably higher number of deals in H1 2020 (35) than in H2 2019 (24) and H1 2019 (26).

Back in H1 2011, 73% of investments in the North East were completed by funds in the same region. Since then, the region has flourished, attracting significantly more attention from funds in other regions (especially those in the West Midlands) and countries.

The largest round in the region so far this year was secured by Partnerize in early January. The round was backed by American technology-focused private equity firm Accel-KKR, and included a loan from SVB.

Since then, the adtech company has secured a further £1.76m round from undisclosed investors. Given that this round was completed in early May, it seems likely that the finance was needed as a result of COVID-19. In total, Partnerize has secured 12 funding rounds totalling £72.1m.

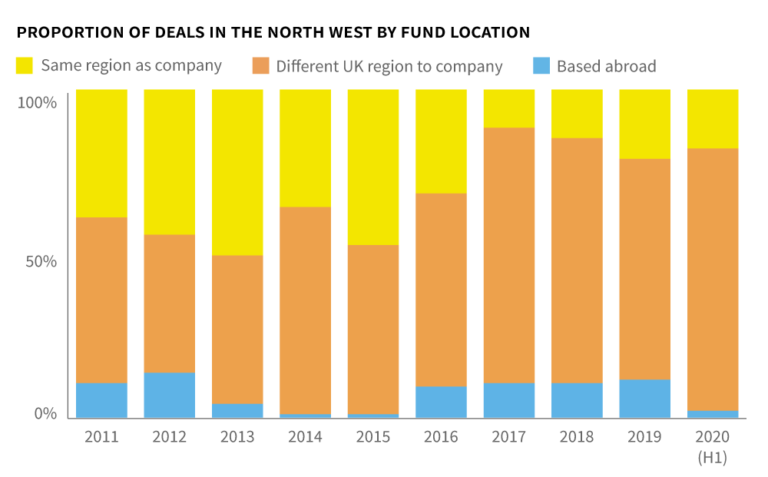

Inward investment in the North West

The North West has a fairly diverse high-growth ecosystem, with a strong cohort of up and coming tech startups, as well as a number of ambitious scaleups that have been around for decades. The region attracts investment from all over the UK, but especially London and Scotland. Funds based in the South West, West Midlands and Yorkshire and The Humber are also regular investors in the region. Investment from foreign investors appears to have tailed off after a sustained level of interest between 2016 and 2019.

The region saw 49 deals completed in H1 2020, down from a high of 68 in H1 2018. The biggest round this year was secured by ITS Technology Group and totalled £45m. This accounted for almost half of the total amount invested into North West-based businesses between January and June 2020. The round was backed entirely by London-based Aviva Investors.

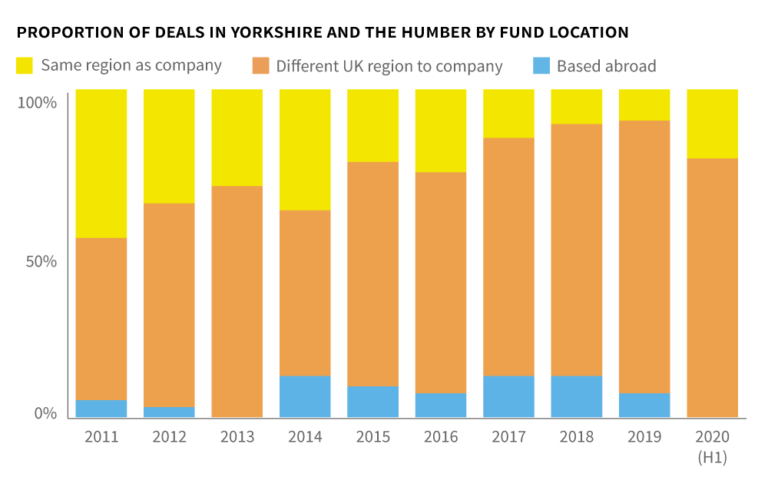

Inward investment in the Yorkshire and The Humber

Yorkshire and the Humber is the only region to not secure any foreign investment in H1 2020.

Just 19 investments were announced in the region in the first half of 2020, down from 30 in the previous half and a high of 35 in H1 2019. The biggest deal so far this year was secured by Quantum Motion Technologies, totalling £8m. The round was backed by INKEF Capital, IP Group, National Security Strategic Investment Fund, Octopus Ventures, Oxford Sciences Innovation and University of Oxford Innovation Fund.

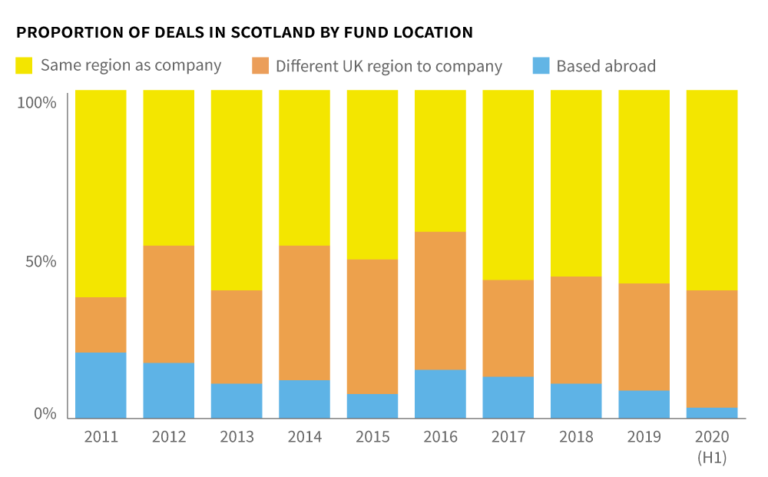

Inward investment in Scotland

Scottish companies have access to some of the most focussed financial aid in the country. Scottish Enterprise and Scottish Equity Partners are incredibly active, resulting in a low proportion of inward investment. So far this year, a record 61% of Scottish deals were backed solely by Scottish funds.

Having said that, Scotland has suffered a rather staggering blow to raw deal numbers so far this year. Just 70 equity investments were announced in the first half of 2020, down from a high of 128 in H2 2019. The total amount raised also plummeted, from £242m to £76m.

The biggest round of the year so far was secured by SHE Software and totalled £6.97m. The round was backed by Camden-based Frog Capital, Northern VCT and other undisclosed investors. Incorporated in 1996, SHE Software is a well-established company that has secured six rounds of funding totalling £13.1m since 2012. Based in South Lanarkshire, the company develops a software-based management system that helps to maintain businesses’ health and safety needs.

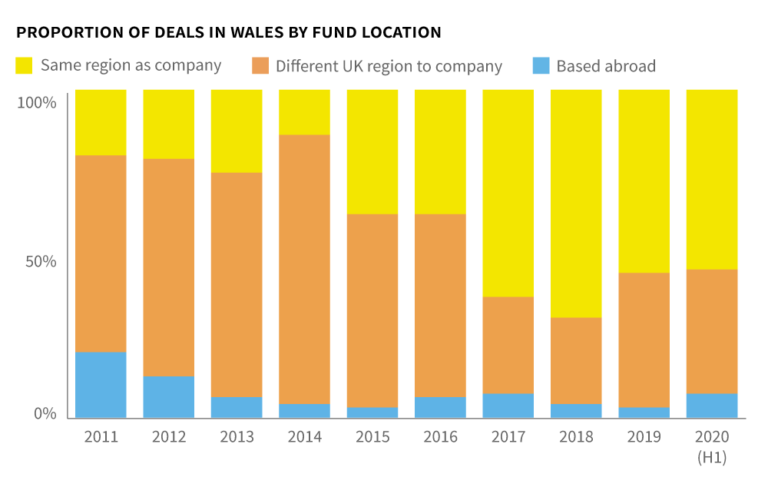

Inward investment in Wales

Funds based in Wales have been showing a lot more activity since 2016. In 2018, a massive 70% of deals secured by Welsh companies were solely backed by Welsh funds. This has now evened out to around 55%. Much of this activity is down to the Development Bank of Wales, a devolved government fund that provides debt, mezzanine finance and equity funding to high-growth companies in Wales.

It’s fairly uncommon for companies in Wales to secure foreign investment, with just one or two announced deals each year involving participation from a foreign fund. Inward investment into the region tends to come from London or the South West. Wales’ largest recipient of funding so far this year is Transcend Packaging, which manufactures packaging products for the food industry, such as paper straws and folding cartons. The company secured a £10m equity round towards the end of June, with participation from Westminster-based IW Capital and other undisclosed investors.

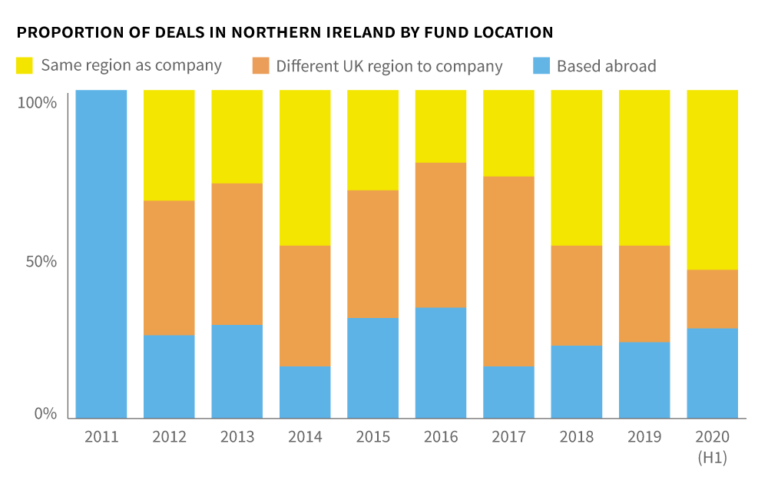

Inward investment in Northern Ireland

Northern Ireland has a relatively nascent high-growth economy. Back in 2011, just two equity fundraisings were announced, both of which included foreign investment. In H1 2020 the region secured 12 announced equity rounds, down from a high of 21 in H1 2019.

We track just 11 active funds in Northern Ireland, but they’re doing much of the legwork in the region, leading on half of the deals in H1 2020.

Based in Lisburn and Castlereagh, blind manufacturer Decora was the recipient of the biggest investment round in Northern Ireland this year, which totalled £10m. Already an established business, this was the company’s first investment round and it was funded entirely by BGF, based in Westminster.

Want to find out more?

The health of our regions in the face of coronavirus has never been more critical. In order to stimulate the economy, inward investment teams at LEPs up and down the country will be shifting their focus from deploying government support, to encouraging new business and investment into their area.

Beauhurst is an essential tool for those who want to carry out an efficient and effective inward investment campaign, with world-class data and state-of-the-art search and visualisation tools. For further information on how you can leverage the platform to engage with businesses and promote your region, click here. Or book a demo below to see the platform for yourself

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.