Is UK tech over-funded?

Category: Uncategorized

We track thousands of British high-growth businesses across every sector imaginable. But we know that there is a greater pool of interest around some sectors than others, particularly when it comes to investors. We dug into our data to see how it bears this out, and to see if we could shed some light on why some entrepreneurs in certain sectors may struggle more than others to raise investment.

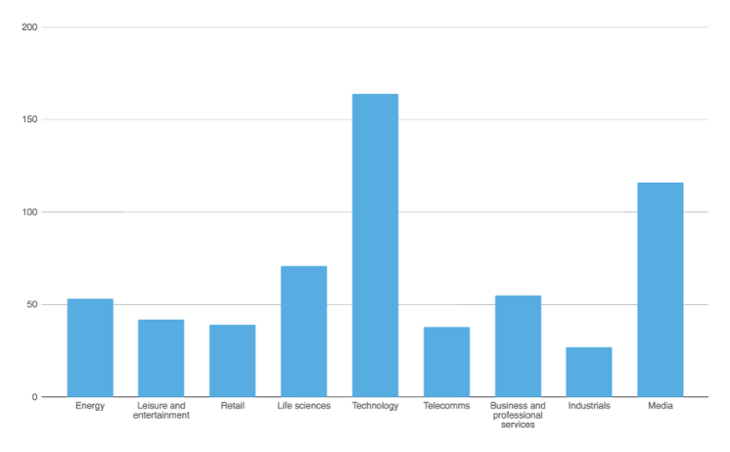

Looking into the stats, we’ve found that there appears to be an outsized interest in the technology, media and life science sector groups. There are 71 funds that state a focus on companies in life sciences, 116 for media, and 164 that are, more loosely, interested in tech businesses.

This breakdown confirms what we already know: that tech businesses attract a disproportionately large number of equity investors. Some (particularly those that are R&D-intensive) also need larger amounts of capital to grow, and standard debt or bootstrapping may not be attractive or even possible.

It’s worth clarifying that at Beauhurst, we only classify businesses as tech if development of technology is core to their business model, product or proposition. An insurance provider with a website is not a tech business in the same way as a company whose main output is a web platform, or which has created its own software.

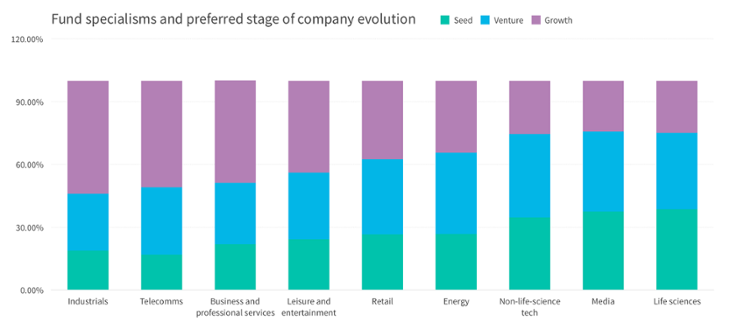

We found some interesting results when we delineated these sectors according to the stages at which companies tend to be funded. When this is done, we can see that there is wide disparity in the funding priorities of investors in different sectors:

Within the life science, media and technology sector groups there is a greater focus on younger businesses – respectively, 38.7%, 37.4% and 34.8% of total funds claim that they specifically fund seed-stage companies. This is much higher than the mean for all sectors, which stands at 26%.

Whereas life sciences, technology and media investors all have an above-average focus on seed funding, a few sector groups have what could amount to the opposite. Only 16.9% of telecomms-specialist funds, and 18.9% of industrials-specialist funds, for instance, focus on seed-stage investments.

What to make of this? It could be the case that the sectors with few seed investors may have better access to debt financing from banks and other traditional funding sources. This would certainly seem plausible for industrial companies that we might expect to have significant physical assets to use as collateral.

This analysis looks only at funds that have specific sectoral preferences, and it is quite possible that the sectors that appear deprived of investment are merely being served by sectorally agnostic funds. This explanation would account for why we’ve found that specialist funds concentrate on sectors that particularly require expertise, such as the life sciences.

It could also indicate, however, that there is a troubling lack of investment into some UK sectors – particularly at seed level. These less glamorous sectors may be suffering from a shortage in early-stage investment which could be hampering growth in key sector groups.

Alternatively, we might conclude that there is a glut of investment into a few of the sectors that are considered to be more innovative (or, at least, fashionably innovative), resulting in too much money chasing too few tech businesses. If so, it seems possible that investors are overvaluing businesses in these popular sectors. Many journalists have argued the same, particularly in the wake of high-profile failures. But investment is not a zero-sum game, and when it comes to data, the jury is – so far – still out.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.