Investment in UK startups falls by largest amount in five years

Category: Uncategorized

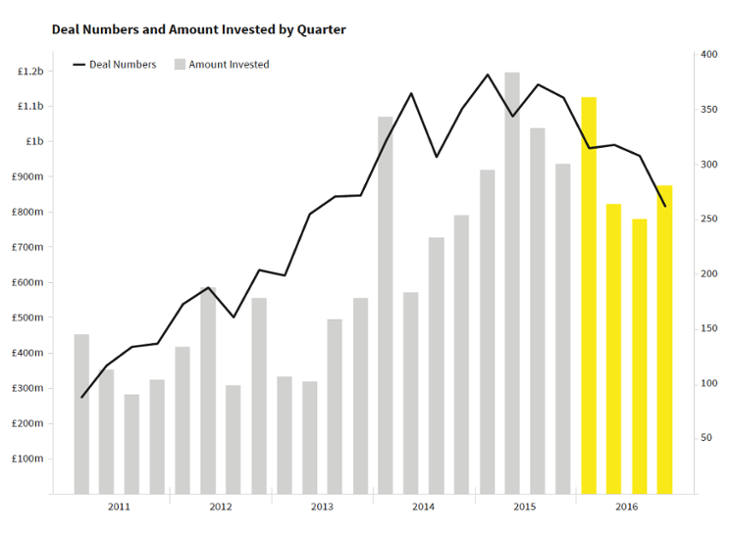

We’ve just published our latest edition of The Deal, looking at all equity investment across the whole of 2016. Until 2016, equity investment into UK companies had increased every year since 2011. That was true despite quarterly drops, despite a change of government, and despite an initially turbulent economy. Now, examining full-year data, it has fallen for the first time.

The decline was felt most keenly by companies at venture stage, although not by a significant margin — companies at all stages saw a drop in deal numbers. Similarly, the fall left few sectors untouched, with the notable exception of life sciences. Seed-stage life sciences companies saw a 19% increase in deals, with a record £202m invested. Retail businesses, however, saw a 39% drop in number of deals, and supply chain companies certainly felt the pinch as 52% fewer deals were undertaken.

As well as an overall decline, 2016 saw some unusually large deals. The biggest fundraising went into food delivery company Deliveroo, which secured a colossal £210m: the second-largest equity raise by a UK startup since that of Metro Bank (£388m) in 2014. Skyscanner also raised £128m, suggesting that the future is not entirely bleak for B2C technology companies.

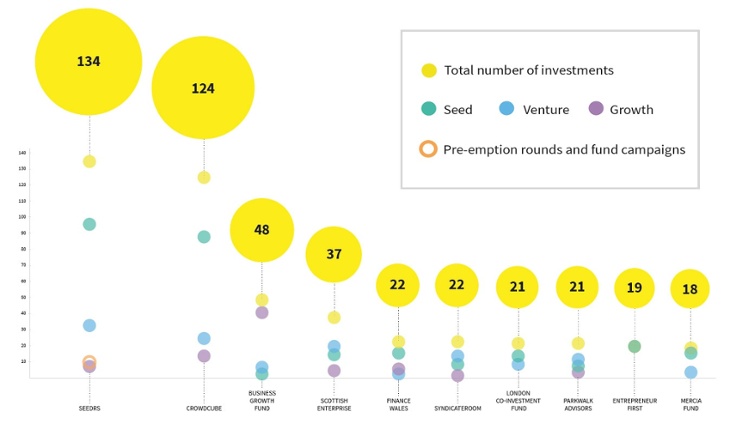

That said, if there is a reason to be optimistic about prospects for equity finance, it lies with crowdfunding. Despite the overall fall in deal numbers seen by crowdfunders, at growth-stage deal numbers increased by 10%. And around 80% of these companies were crowdfunding for the first time. Equity crowdfunding platform Seedrs marked a record month in October, raising almost £20m. Jeff Lynn, Seedrs CEO, commented that “2017 will be the year in which institutional capital begins to play a meaningful role in equity crowdfunding. We are now beginning to see the first exits from investments made at the beginning of the equity crowdfunding era…Where we are today is roughly where peer-to-peer lending was when institutional investors first entered that space.”

Similarly, Crowdcube saw investments up 20% post-Brexit, and the average deal size increase from £550k to £642k (a 16% rise). Indeed, Crowdcube commented that “From our discussions with entrepreneurs, it is clear that many put fundraising plans on hold in anticipation of the referendum…It’s encouraging to see that the crowdfunding industry is outperforming the market.”

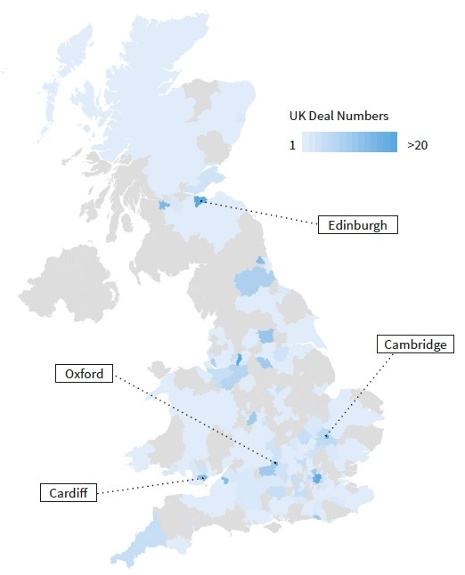

In terms of regions, London took half of all fundraisings in 2016. The strongest borough in London by deal numbers was Hackney, with 88 equity investments totalling £153.5m. The only two locales to escape the malaise were Northern Ireland and Wales; deal numbers increased by 8% in the former and by 30% in Wales.

An analysis of a cohort of companies who raised equity in 2011 tells a positive story — 15% have exited. The rest of the cohort has seen their total valuation grow from an average of £2.97m to £12.7m. Just 12% failed, meaning that a company which raised equity investment in 2011 has so far been more likely to succeed than die. It remains to be seen how a later cohort of companies will fare.

The outlook is broadly negative, but not universally so. Overall Brexit has had no discernible short-term effect, though the uncertainty around the referendum is likely to have contributed to the collective decline in deal numbers. But despite the shock of deal numbers’ first annual fall, there are clear positives emerging.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.