The Importance of ESOPs in Early-Stage Ventures

Harry Walker, 21 December 2023

Through a series of blogs, the PwC Venture & Growth team are conducting research and providing insights into Term Sheets. This iteration of the series focuses on ESOPs and the importance of ESOPs for early-stage, venture-backed businesses.

According to Beauhurst data, there are currently 12.5k active, seed-stage businesses operating in the UK. This makes up 24% of active firms. Seed-stage businesses are at the earliest stage of their development. These companies are usually made up of a small team and have a low valuation. Funding for these businesses normally comes from grants or business angels.

What is an ESOP?

An ESOP (Employee Share Option Pool) is a form of a stock ownership plan that provides employees with stock options in the company they work for. By making stock options part of an employee’s remuneration, businesses can incentivise employees to help optimise the growth of the business. It also assists early-stage firms in attracting and retaining top talent, as well as achieving growth objectives, even in their illiquid states.

“Options are massively important. Everyone in the business needs to be participating in its growth journey - they help you attract the best talent as a growing business when other avenues available to that talent may pay higher starting salaries.

Without the effective allocation of options to key early-stage employees, start-ups would face an uphill battle in attracting, retaining and incentivising the best talent to help them grow. They are a key part of any investment terms and founders should give equal weight to them along with other economic and structural terms of any deal.”Ed Reid, Senior Manager

Exits in the UK

What were the findings of the PwC analysis?

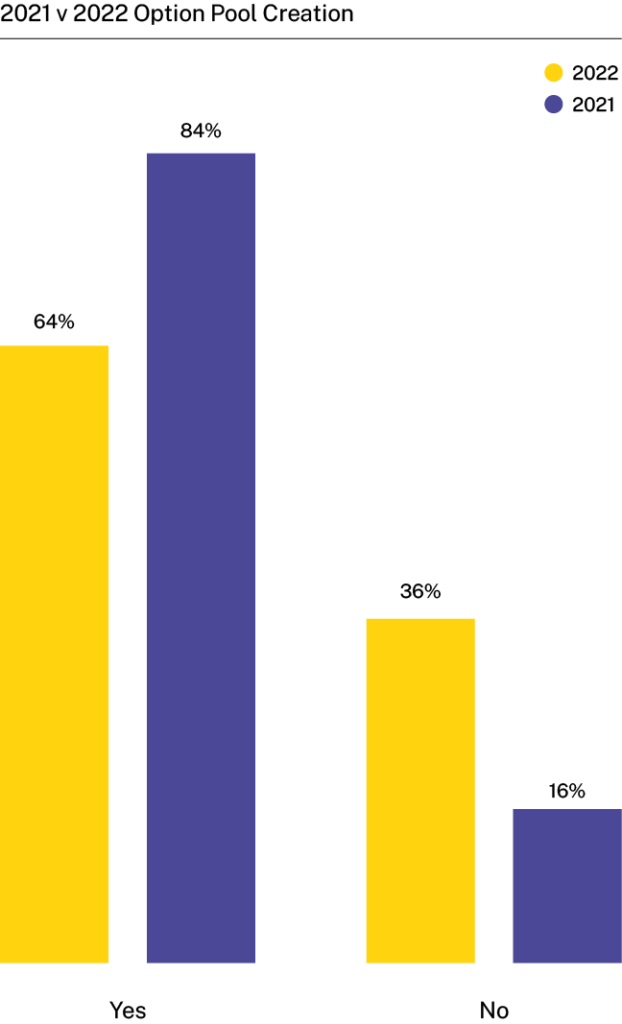

Finally, the creation of option pools was 20% less common in 2022 compared with the previous year. It was suggested that this was due to tougher conditions for growth businesses, meaning investors must be more selective with capital allocation. Total equity investment for UK firms fell by 7.56% between 2021 and 2022 according to Beauhurst data.

Grow your business.

Get access to unrivalled data on all the companies you need to know about, so you can approach the right leads, at the right time.

Book a demo today to see all of the key features of our platforms, as well as the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations that match your ideal customer profile.

Beauhurst Privacy Policy