365 Days Later: How Lockdown has Impacted UK Startups & Scaleups

Category: Uncategorized

It’s now been more than a year since the UK first went into lockdown, cooped up and trying our best to flatten the curve and slow the spread. At last, the vaccine rollout is well underway and we have a clear roadmap out of lockdown restrictions—things are certainly looking up.

Many of us have spent the last year watching the public markets ebb and flow on a day-to-day basis (or perhaps ‘dive’ and ‘surge’ are more appropriate adjectives), but the private markets lack the liquidity to see granular movements. As the dust continues to settle, we’re able to see just how the high-growth landscape has changed over that time, and how the past 365 days have compared to the previous period (where possible).

Impact on high-growth business operations

Upon Hancock’s announcement on 16th March 2020 that all unnecessary contact should cease, we picked up our laptops, packed our chargers and headed home from Beauhurst’s Brixton and Nottingham offices. But knowing that not every company could instantly migrate to a WFH set up, we quickly got to work on illustrating the impact of the lockdown on high-growth businesses across the nation.

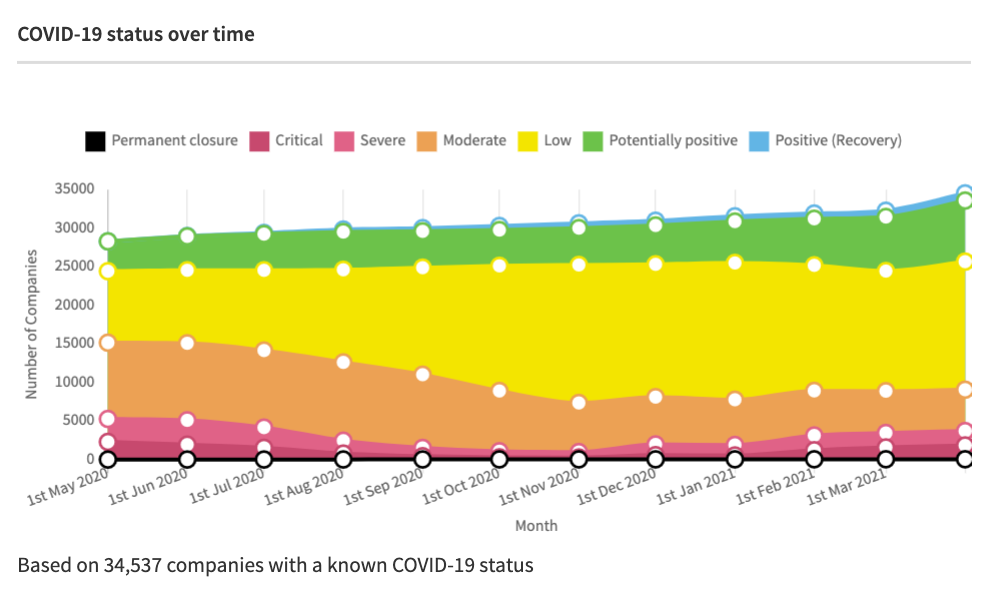

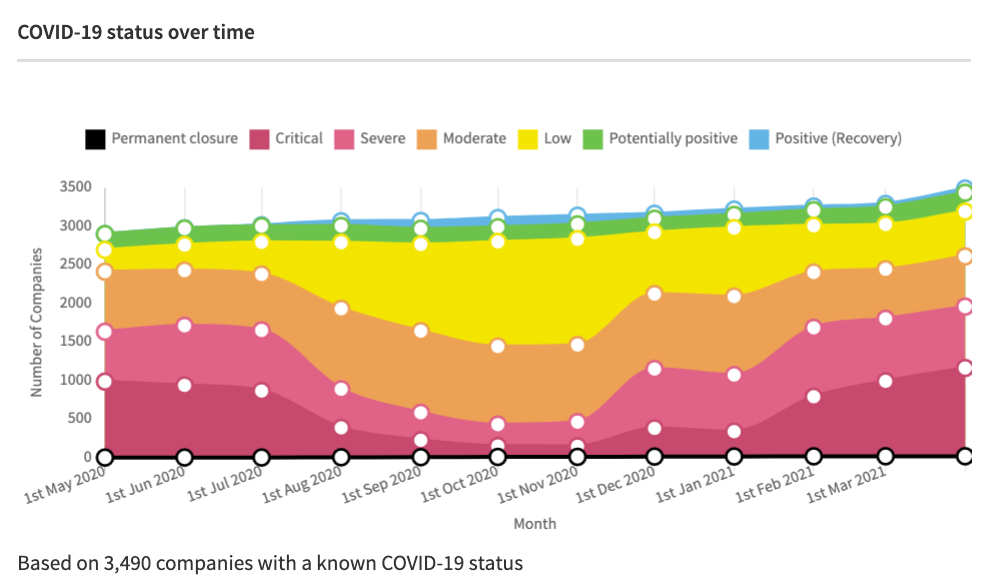

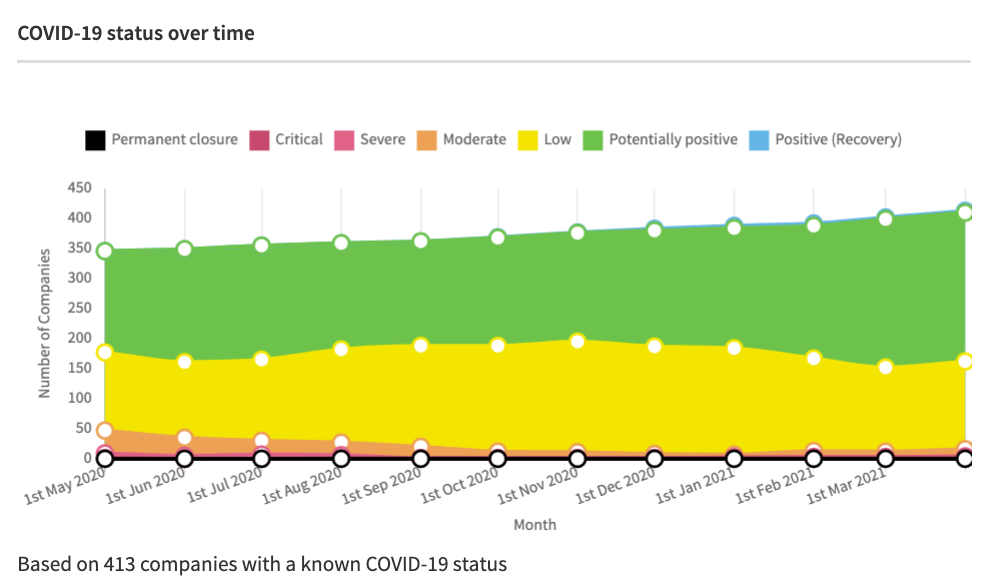

Our data team began reviewing each of the 30,000+ businesses tracked on our platform, assigning up to 16 COVID-19 impact tags per company. These impact tags were then fed through an algorithm, which attributes a status to each company. The tags and statuses have since been updated monthly at a minimum. And as new restrictions have come in (including local firebreak and tier restrictions), we’ve been targeting affected areas and reviewed every company impacted by them, based on their sectors and location.

Obviously, this isn’t data we can compare to the previous period—“the impact of COVID-19 on UK businesses” would have sounded alien last January. But we can see how the picture has developed over the course of the year.

In the first full month of lockdown, 54% of high-growth businesses were negatively impacted (categorised as critically, severely or moderately impacted), whilst 33% saw minimal disruption and 14% experienced potentially positive effects. Numbers looked more positive through the summer months and into Autumn, as COVID restrictions lifted. Shops, offices and local amenities reopened, and many people began socialising again (at a distance, of course).

But the proportion of companies that were negatively impacted by restrictions increased in December, as the second wave crashed through the Christmas period. Now in our third national lockdown, 26% of high-growth companies are negatively impacted, significantly less than in April, but still eye-wateringly high, considering these companies are the powerhouse of UK innovation and technology.

These figures have fluctuated massively across sectors. Retail has understandably been hit hard, but with various e-commerce options, many businesses are still managing to adapt and run well. Today, 43% of high-growth retail businesses remain negatively impacted.

Leisure and entertainment businesses, on the other hand, have had a harder time adapting. This sector remains the worst hit by the pandemic and subsequent restrictions. Even as those restrictions are eased over the coming months, these companies will need to accommodate social distancing and heightened hygiene measures, simultaneously reducing capacity and increasing costs. A staggering three quarters of high-growth leisure and entertainment businesses remain negatively impacted by the pandemic, prevented from opening and losing key customer groups.

Meanwhile, tech (as expected) has remained buoyant, especially ehealth. 61% of ehealth companies are potentially positively affected, whilst 4% are currently negatively impacted.

Fundraisings figures

We often use fundraisings as a measure of success, with high-potential companies tending to raise more capital from investors, in order to fund their ambitious growth plans. So it may look promising that fundraising numbers were up over the past 12 months, with 2,067 worth £12.1b completed between 24th March 2020 and 23rd March 2021, compared with 2,039 worth £11.5b in the previous period.

But an equity fundraise isn’t always sunshines and rainbows. Sometimes, companies have to raise equity in order to extend their runway and keep the lights on. Over the last 12 months, 309 announced fundraisings worth £782m can be considered ‘survival finance’, deployed to companies that have been negatively impacted by the pandemic. This leaves 1,758 positive, growth-focused rounds.

For a more in-depth analysis of recent equity market trends, including hot sectors and valuation trends, take a look at our annual equity report, The Deal (and look out for our Q1 Equity Market Update, due in early April).

Dissolutions, administrations & liquidations

Trends in high-growth company dissolutions, administrations, and liquidation filings have been tumultuous since the start of the pandemic. Sunak’s initial support package clearly reduced (or at least delayed) the number of high-growth company deaths, to a level that was low even in the best of times. This package included CBILS, the furlough scheme, and the introduction of the Future Fund in May.

But six months later, in September, these filings shot through the roof. Government support packages can only do so much when businesses are unable to turn any semblance of a profit. October had the highest number of high-growth company dissolution, administration, and liquidation filings on record, with 306 submitted over the course of the month. It’s worth noting that much of this increase will simply be a correction of the artificial lows throughout the summer months.

Overall, 2,304 of these ‘bad news’ filings were submitted to Companies House since March 2020, compared to 2,359 between February 2019 and February 2020.

Company exits

A global pandemic is arguably not the best time to exit a business, and that’s reflected in acquisition figures. A total of 411 high-growth exits via acquisition were made over the year, compared to 552 in the previous period. In fact, 2020 saw the lowest level of high-growth company exits via acquisition since 2016 (375), although this number may increase slightly as more data trickles in.

*Companies acquired out of administration are not counted in this data.

And high-growth companies made fewer acquisitions of other companies too. Just 415 acquisitions where the acquiring company is high-growth took place between 24th March 2020 and 23rd March 2021, compared to 541 in the period prior. Again, this number may increase as more data comes in.

*Companies acquired out of administration are not counted in this data.

Meanwhile, 12 high-growth UK companies have IPO’d in the last 12 months—including e-commerce unicorn The Hut Group and pharmaceuticals company COMPASS Pathways— compared to 10 in the period prior. This marks a small uptick, but follows several years of declining IPO activity. Given that the public markets are taking off in the US, we expect to see an increase here in the UK in the remainder of 2021, especially as the economy picks up and founders can get more bang for their buck. Want to learn more about UK IPO trends? See our extended analysis and predictions of upcoming IPOs.

Looking to the future

Overall, the past year has been a mixed bag for high-growth UK businesses. Whilst some have managed to capitalise on a more distant way of life, and continued to raise significant sums of money to fuel their growth, others have found themselves at a point of no return.

The looming third wave that’s sweeping across Europe is certainly ominous, but overall things do look a little brighter these days, and we’re optimistic that—should the lockdown easing go to plan—the majority of the UK’s high-growth companies will be able to get back on their feet. We expect to see tech sectors, in particular, show accelerated growth over the coming year.