High-Growth Nottinghamshire 2022: A Summary

Sam Peckett, 21 September 2023

A total of 482 innovative, high-growth companies call Nottinghamshire home. Broadly spread across the county, they’re concentrated in Nottingham, Mansfield and Newark-on-Trent working in a wide range of sectors. Our report “High-growth Nottinghamshire”, written with Invest in Nottingham, highlights the region’s potential and the impressive performance of its businesses.

Take a look at our summary below.

Key Findings

- Nottinghamshire is home to 482 active, high-growth businesses, demonstrating the strength of the region's universities, historical innovation, and significant infrastructure and regeneration investment.

- The region's central location and strong engagement with universities make it an attractive place for business growth and investment. An estimated 61% of the population is under 44 years old, indicating a fresh, innovative, and strong talent pool.

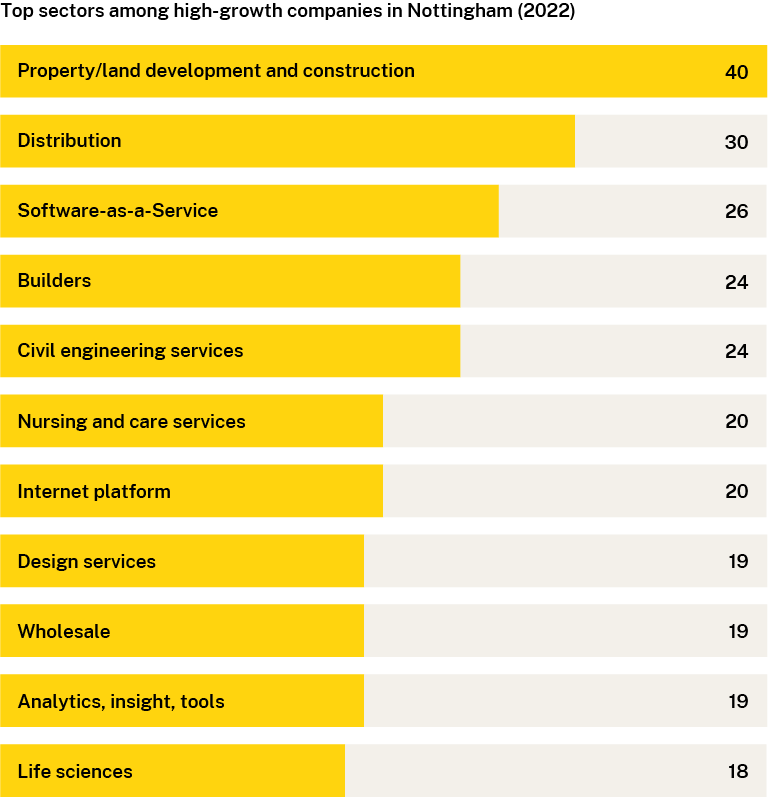

- The region has diverse sectoral strengths, with notable populations of high-growth companies in construction and civil engineering, property and land development,as well as newer sectors such as creative industries, software, and life sciences.

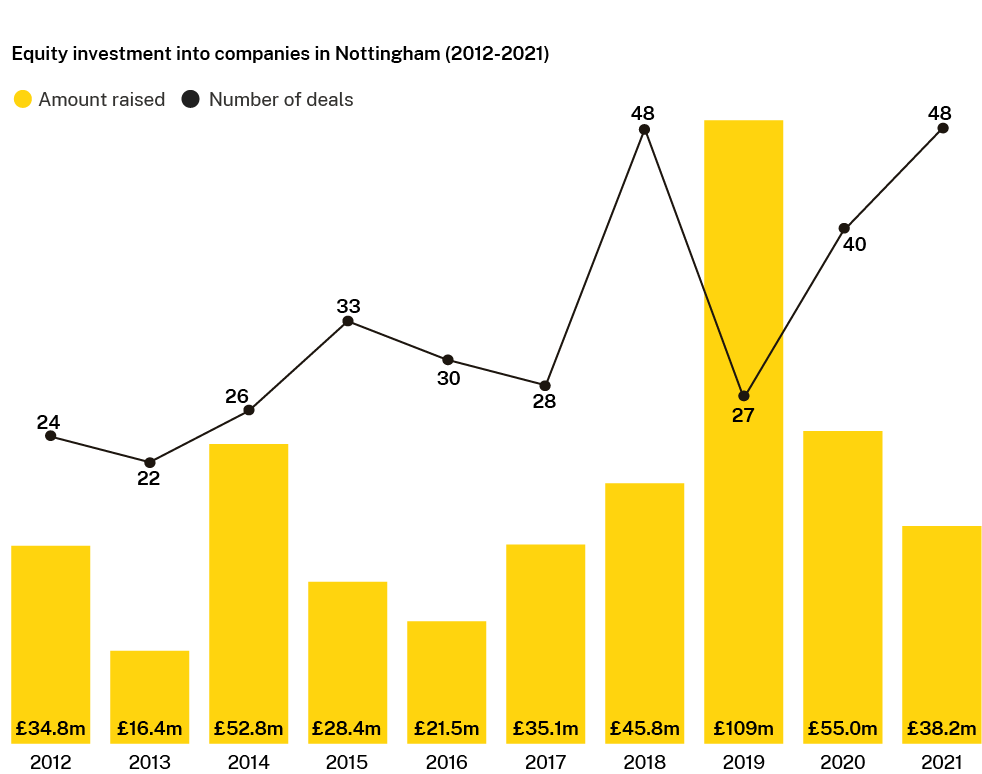

- High-growth companies in Nottinghamshire have raised £437m over the last decade.

A breakdown of the businesses in Nottinghamshire

Our 2022 report with Invest in Nottingham revealed that there was 482 high-growth and innovative businesses in Nottinghamshire, with 86 startups, 147 scaleups and 24 spinouts as of 2022. The University of Nottingham plays a key role in the high-growth ecosystem, with 72.4% of spinouts stemming from it.

Top companies by headcount growth

Healthcare product company Blueskeye AI has grown 233% year-on-year and tops our list. It’s closely followed by cleantech company GeoPura with 200% headcount growth. Third is food and drink company The Skinny Food Co at 175%.

Take a look at the full report for more details.

Top companies by investment

Pharmaceutical company Quotient Sciences has raised more than any other company in Nottinghamshire between 2012 and 2021 at £107m in two equity rounds. Collaboration tool company Huddle is next highest with £48.7m raised across seven rounds, followed by online games company Lockwood Publishing, which has raised £20.2m in two rounds.

Top sectors

Property/land development and construction leads the way in Nottinghamshire. It makes up 8.30% of the county’s 482 tracked companies, above the national average of 6.08%.

Tech sectors feature prominently, with Software-as-a-Service (SaaS), internet platforms and analytics, insight and tools all ranking highly. SaaS companies have secured a combined total of £22.1m in equity funding between 2012 and 2021, with £9.37m going to Adzooma.

Investment trends

The number of equity investments secured by companies based in Nottinghamshire doubled from 24 deals in 2012 to 48 in 2021, with fluctuations along the way. A total of 48 deals took place in 2018, which is the peak we’ve seen in a single year.

Nottinghamshire-based companies secured an impressive £55.0m in 2020, despite the risk-off approach by investors at the time against the backdrop of Brexit and COVID-19.

Top investors

From the 326 equity investment deals that have taken place, crowdfunding platforms Crowdcube and Seedrs ranked as two of the top investors. This reflects the UK’s wider high-growth landscape, showing the importance of crowdfunding platforms for early-stage businesses. These are closely followed by the Midlands Engine Investment Fund, Foresight Nottingham Fund and the University of Nottingham, all focused on supporting businesses in the region.

Spinouts

Outlook for the future

Over 30% of high-growth companies active in the ecosystem are seed or venture stage, suggesting a fresh wave of innovative companies are aiming to make their mark in the region.

The region has raised a total of £437m in equity investment via 326 deals over the past decade. As more Nottinghamshire companies innovate and scale, we can expect investor interest in the region to grow.

For more analysis, read the full report.

Methodolody

Grow your business.

Get access to unrivalled data on all the companies you need to know about, so you can approach the right leads, at the right time.

Book a demo today to see all of the key features of our platforms, as well as the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations that match your ideal customer profile.

Beauhurst Privacy Policy