Drone startups high-fliers within UK tech sector

Category: Uncategorized

Prior to 2010, the word ‘drone’ connoted either a tedious monologue or something reminiscent of science fiction. That all changed, however, with the advent of remote-controlled aircraft. Drones are now widespread in warfare, but they also have a wide variety of commercial and recreational applications. Beauhurst tracks 20 UK-based drone startups that have received equity investment, and only one of these – OpenWorks Engineering – is explicitly designed for conflict.

OpenWorks’ first product, the SkyWall 100, is a drone-catching bazooka:

The rest of the startups, however, have a diverse range of applications for their products – some of which include leisure pursuits. Shooting Reels, for instance, is developing drones explicitly for the marketing and film industry; BB Stratus (discussed in detail below) has a similar brief.

Other key areas in which drones are operating include mapping, land surveying, and agriculture. BioCarbon Engineering is distinctive in that it combines all three of these functions. The company is developing drone software which can map in 3D deforested areas, autonomously plant tree seeds, and proceed to monitor regrowth:

Indeed, many of these companies do not develop drones themselves, but the programs and software capable of controlling them. Altitude Angel has developed drone management software that enables users to avoid collisions and no-fly zones. Flock is developing software to drive drones in cities in order to reduce the risk of accidents to citizens. 4×4 Aviation (recently dissolved) designed and patented technology that it claimed would help make vertical take-off and landing (VTOL) aircraft commercially viable.

Perhaps the most futuristic startup of all is Malloy Aeronautics (MA), which has developed the below ‘hoverbike’. Capable of carrying 130kg, the ‘bike’ can deliver aid, be controlled remotely, and fly to the same speed and height as a typical light helicopter. According to MA, the vehicle can also operate safely close to the ground and around people, and requires little or no training to use.

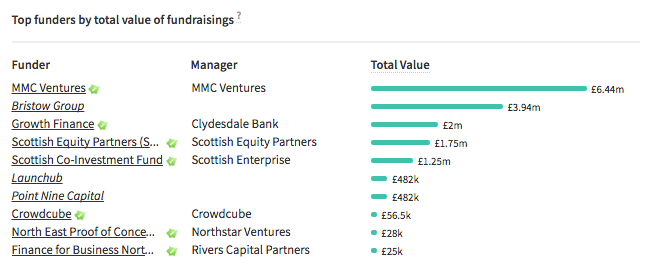

Together these firms form an impressive cohort. But who’s backing them? The below table shows funders of these SMEs, ordered by amount invested overall:

MMC Ventures, the top investor, usually invests between £2m and £3m. The fund will typically invest up to £3m in the first round of funding and up to £5-£7m over time. This model has proved accurate here: MMC Ventures’ chosen investee is Sky-Futures, into which it has co-invested a total of £6.44m over two funding rounds (£2.5m and £3.94m). This latter fundraising was supported by the Bristow Group, which notably does not invest in the UK under normal circumstances.

Indeed, Sky-Futures has secured more equity investment than any other high-growth company in this cohort, raising a total of £7.8m. Its closest competitor is Cyberhawk, which has secured £4.2m from backers including the Scottish Co-Investment Fund and Growth Finance (which gives funding only in the form of loans). Both Sky-Futures and Cyberhawk provide drone services tailored specifically to the oil, gas, petrochemical and utility industries.

There’s no question that drone technology startups are well-positioned in the current market. Despite UK equity fundraisings into high-growth companies falling by 10% in the last quarter, investment into drone technology is only increasing. The below chart shows both the number and value of deals into UK drone companies over the past six years.

The vast majority (75%) of these fundraisings have been unnannounced. This means that Beauhurst analysts have discovered them independently of press releases, news coverage, or company website updates. Should the above trend continue into next year, the UK is looking at approximately £15m worth of funding into young drone companies.

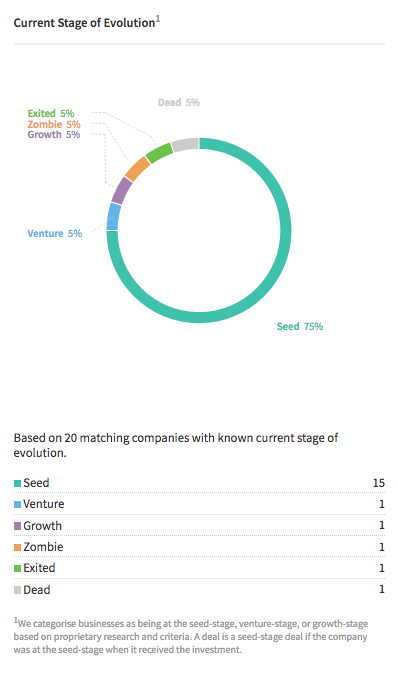

And these companies are indeed young: three quarters of them have not yet grown out of their seed stage. This suggests a relatively high level of investor confidence in their potential: investing into seed-stage companies carries more risk than opting for a venture- or growth-stage startup.

The company to have exited successfully is BB Stratus; it was acquired by Flying Pictures in mid-July of this year for an undisclosed price. Flying Pictures, an aerial film company, boasts Bond films and Harry Potter amongst its credits; this latest acquisition is certain to add promise to its portfolio.

This last aside, hopes for UK drone technology are high – and warrantedly so. That said, not all news is good – drones are increasingly becoming a matter of state concern as they begin to cause problems for passenger aircraft. Perhaps companies like Altitude Angel, mentioned above, are going to be the real high-fliers of the sector. It’s certainly one to watch.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.