The Rise of In Silico Medicine: A Summary of the UK Landscape

Sam Peckett, 14 September 2023

In silico studies are an emerging discipline that use computational modelling and simulations to undertake virtual experiments. There’s potential for it to revolutionise life sciences and healthcare, and it’s gaining significant traction in the UK. Our report “In Silico Medicine” was released in January 2023 in collaboration with Innovate UK, and gives an overview of the in silico landscape in the UK, highlighting key statistics, trends, and insights.

Below is a summary of the report.

Key Findings

- In silico studies utilise computational modelling to simulate or predict cellular, molecular, or even subatomic interactions, such as DNA replication, protein folding, and RNA splicing.

- These techniques have been used for around 30 years, often in combination with in vitro research methods. However, in silico approaches have increased over the last few years thanks to upgrades in computational power and innovations in machine learning and computational sciences.

In Silico in the UK

The UK life sciences industry generated £94.2 billion in turnover in 2021, a 9% increase from the £86.4 billion turnover in 2020.

Alongside benefits to the UK economy and NHS mission and sustainability, in silico medicine presents socioeconomic opportunities and a growing market to tap into. The global in silico drug discovery market size was valued at US$2.8 billion in 2022 and is expected to reach US$5.1 billion by 2030 at a compound annual growth rate (CAGR) of 7.1%.

By capitalising on its excellent public and private R&D capabilities, NHS infrastructures, and investment capabilities, the UK will become the best milieu for delivering medical innovations using in silico evidence and regulatory science.

UK In Silico Cohort Demography

The UK is home to 77 in silico companies that are either currently active, independent private companies or have historically been part of this category but have exited via acquisition or IPO or have ceased operations. London is home to the largest number of these, with 22. It’s followed by the East of England with 14 and the South East with 10. Of the 54 high-growth in silico companies, 44 (81.5%) are at the seed or venture stage.

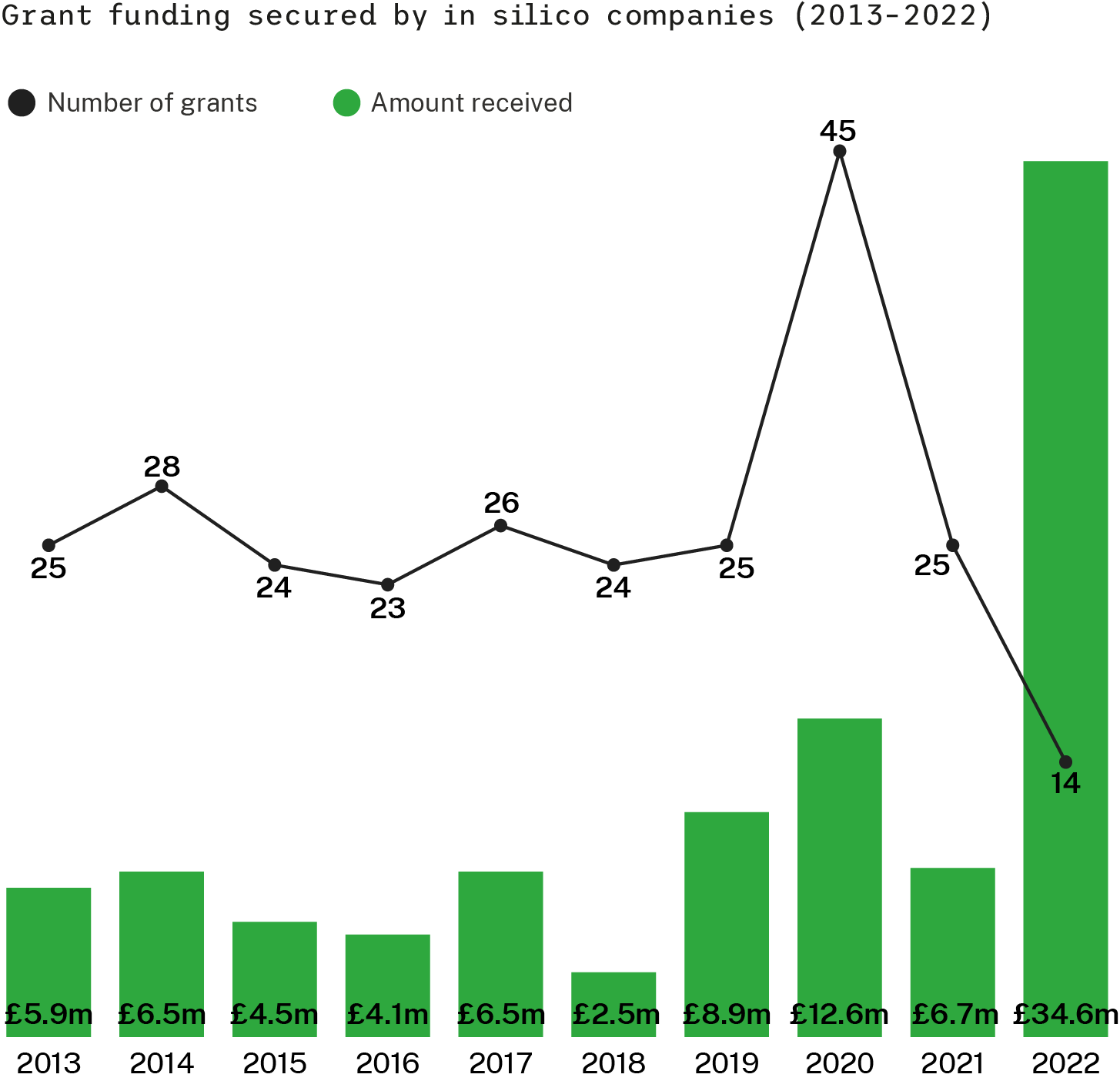

Between 2013 and 2022, in silico companies have received £92.9m in grant funding across 260 grants, and 26 were spun out of an academic institution. Female founders make up just 13.3% of the founder population for in silico companies.

Check out the full report for a more detailed breakdown of stats.

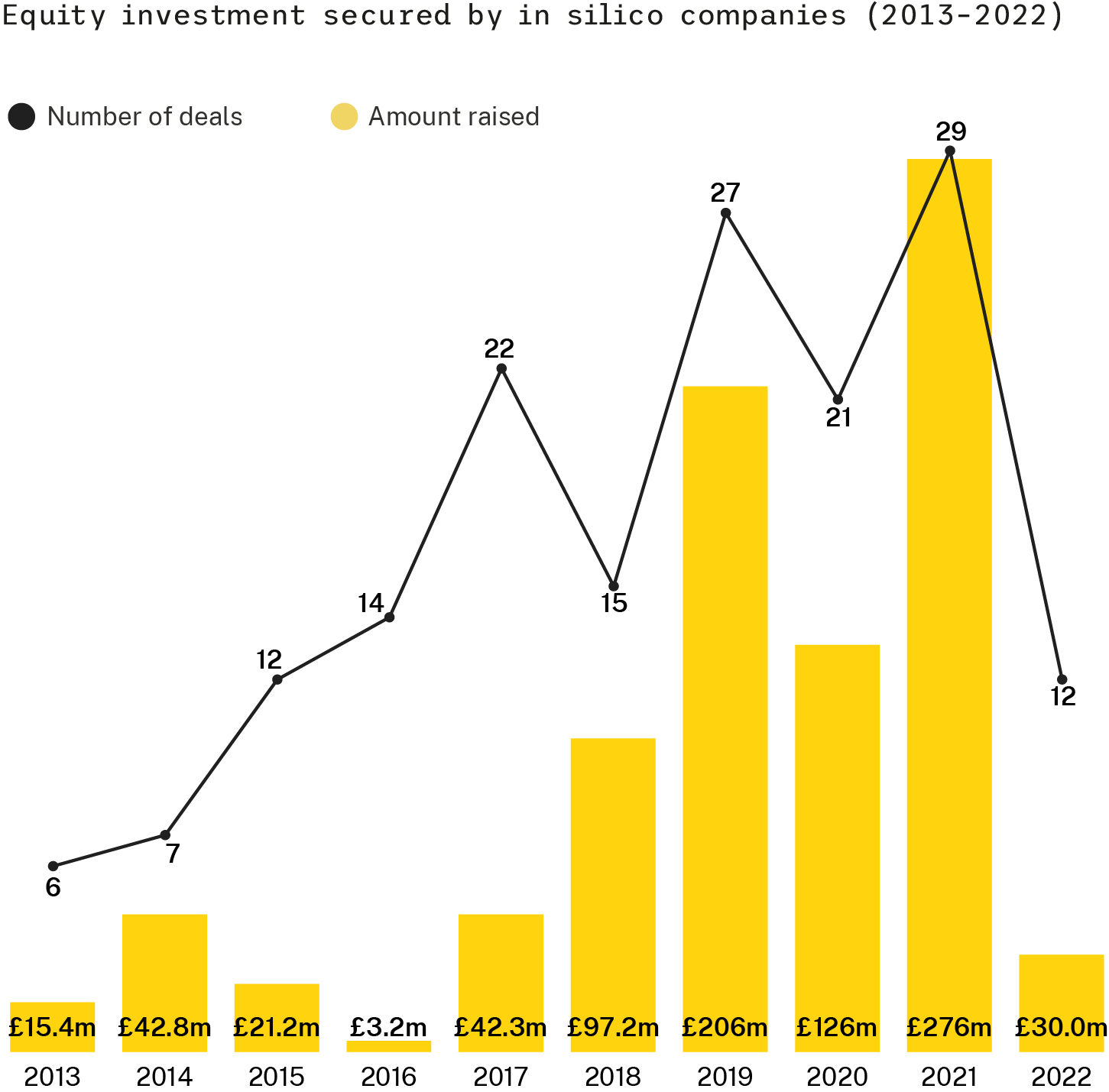

Equity Investment

Companies that utilise in silico techniques secured significant equity investment over the past decade, with a total of £860m raised between 2013 and 2021. In this time the number of deals increased six-fold, while the total value of these deals increased by almost twenty-fold—from £15.4m in 2013 to £276m in 2021.

Exscientia, an AI pharmatech company headquartered in Oxford, is the top invesstee, with a total of £300m in equity deals. It’s closely followed by BenevolentAI, a drug discovery and development company, with £253m raised.

The top investors by number of equity deals are Mercia Fund Managers, Cambridge Angels and ACF Investors, with six deals each from 2013-2022. In this time, 165 equity investment deals have taken place.

Take a look at the full report to see the rest of the top investors and raisers in the in silico sector.

Key Takeaways

Grow your business.

Get access to unrivalled data on all the companies you need to know about, so you can approach the right leads, at the right time.

Book a demo today to see all of the key features of our platforms, as well as the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations that match your ideal customer profile.

Beauhurst Privacy Policy