Spotlight on Spinouts 2023: A Summary

Sam Peckett, 21 September 2023

Our Spotlight on Spinouts, 2023 report provides a comprehensive analysis of the spinout landscape in the UK. Created in collaboration with the Royal Academy of Engineering, it highlights the crucial role spinouts play in commercialising intellectual property from academic institutions and contributing to the economy.

Key findings

- There are 1,166 active spinouts from UK academic institutions since 2011. These account for 2.52% of the UK's high-growth company ecosystem and secured 9.11% of all equity finance raised by private UK companies in 2022.

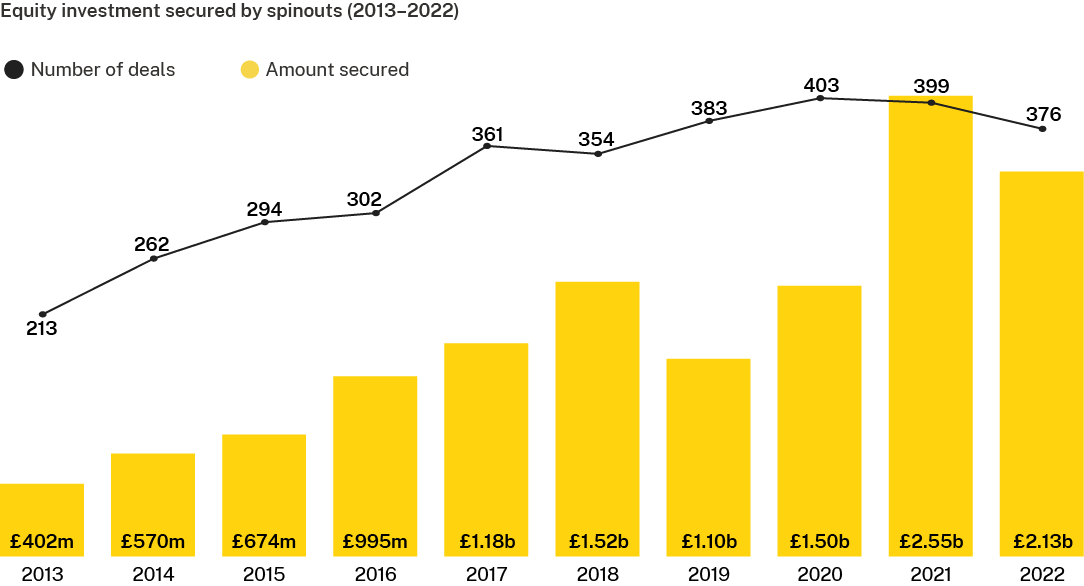

- University spinouts amassed a total equity investment of £2.13b in 2022, showcasing an impressive ability to raise funds.

- Of the total count, 56.5% were in the seed stage, indicating remarkable growth potential.

Demographics of the spinouts

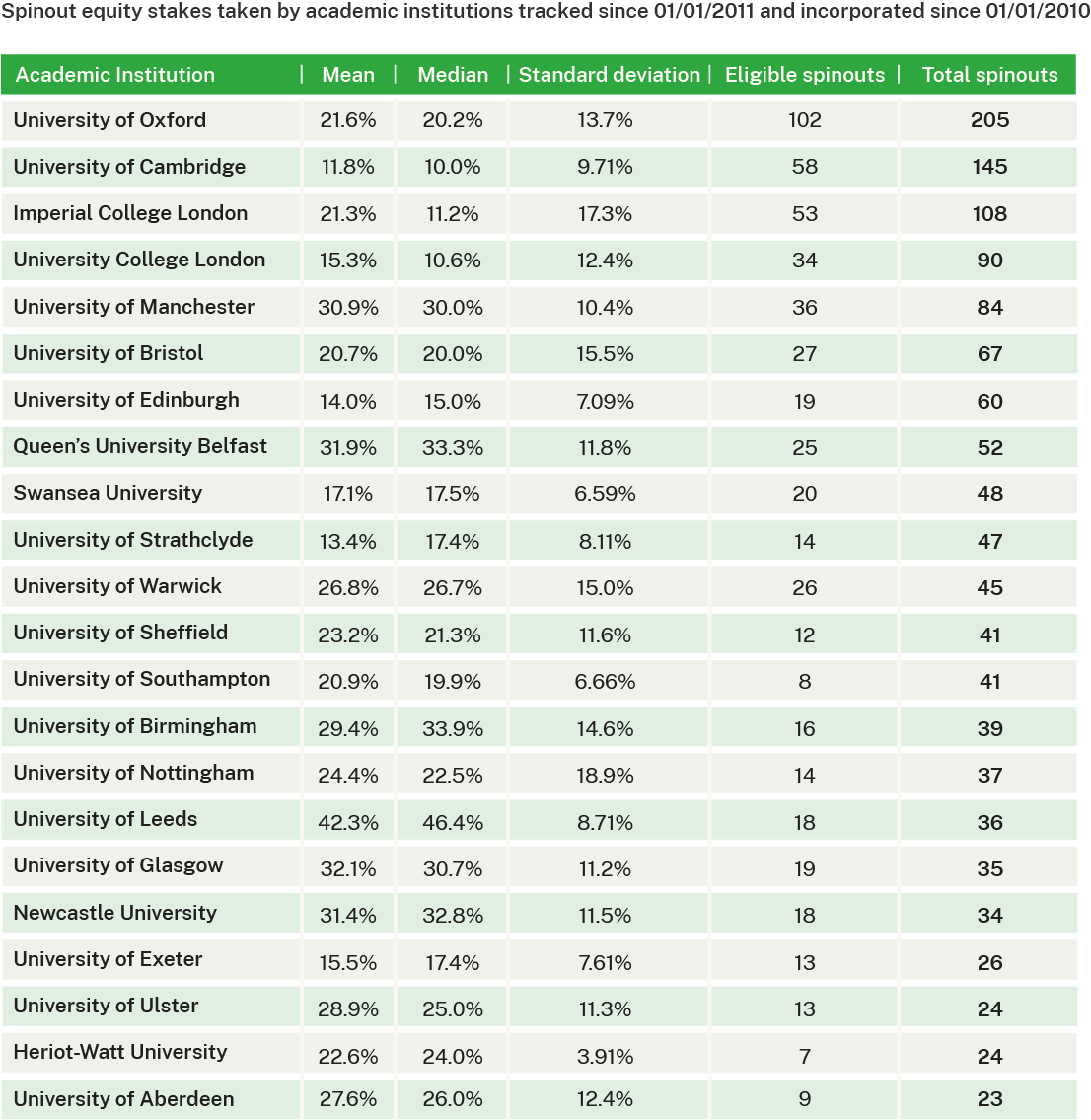

Ten academic institutions have accounted for 51.8% of spinouts since 2011. The University of Oxford tops the list with 205 spinouts, while the University of Cambridge came second with 145. Imperial College London is the only other university with over 100 spinouts, at 108. The University of Leeds had the greatest increase in its total number of spinouts, growing 28%, from 26 to 36.

The life sciences sector continues to lead the way, with pharmaceuticals topping the sectoral rankings with 309, closely followed by research tools/reagents with 279. Academic institutions are pivotal to the sector, which utilises extensive research and state-of-the-art facilities to further scientific innovation.

Check out the full report to see the top 42 institutions, along with details on regional distribution and sectors.

Funding sources and investment

The value of funding rounds secured by spinouts rose fivefold—from £402m in 2013 to £2.13b in 2022—with the total value over this period at £12.6b across 3.34k equity deals. There has been a slight decline in the value and number of deals involving spinouts from 2021 to 2022. A total of £2.55b was raised in 2021 across 399 deals, compared to 2022’s 2.13b across 376 deals.

However, 2022 is still the second highest year on record by value of equity invested. Across the past decade, the average size of equity financing rounds has increased by 1.87x with the mean deal size in that time period at £3.91m, reaching £5.71m in 2022.

Read the full report to find details on top investors and investees.

Survival, growth and exits

Of the 1,718 academic spinouts in the UK, 297 (17.3%) have ceased operations. The average age of UK spinouts at death from 2013-2022 was 7.93 years.

Of the 1,166 active spinouts in January 2023, 56.5% were at the seed stage, 29.0% at the venture stage, 8.67% at the growth stage, and 5.83% established. A total of 177 spinouts have achieved exits in the form of an acquisition or IPO from 2013 to 2022. Acquisitions are more common, making up 81.9% of all exits, with the remaining 18.1% floating on the public market.

Leadership

All-male founders make up 75.4% of all spinouts, with 17.0% mixed gender and 7.6% all female. For directors, 52.1% are all made, 44.9% are mixed gender and just 3.0% are all female. This analysis excludes companies where one or more founder or director genders are unknown.

The mean age of active spinout founders is 47.3, with 28.2% of all founders in the 40-49 age bracket, the most of any ten year bracket.

Equity stakes and IP policy

The mean stake taken by universities decreased from 24.8% in 2013 to 17.8% in 2022, the lowest average stake in the ten-year period.

Take a look at our full report to see details on University IP policies.

Methodology

Beauhurst tracks all spinouts deemed to have spun out on or after 1 January 2011. Spinning out from an academic institution is one of our eight triggers that we believe suggests a company has high-growth potential. Companies that spun out of an academic institution prior to 1 January 2011 may still be included in this report if they achieved one of the other seven triggers after 1 January 2011 and then were subsequently determined to be a spinout.

For equity investment to be included in our analysis, it must be:

- Secured by an academic spinout

- Some form of equity investment

- Secured by a non-listed UK company

- Issued between 1 January 2013 and 31 December 2022

We define an academic spinout as a company that meets condition 1 and at least one condition out of 2-4:

1. The company was set up to exploit IP developed by a recognised UK university or research institution (this is broadly in line with the Higher Education Statistics Agency’s (HESA) definition of a spin-off)

2. The institution owns IP that it has licensed to the company

3. The institution owns shares in the company

4. The institution has the right (via an options or warrants contract) to purchase shares in the company at a later date

Grow your business.

Get access to unrivalled data on all the companies you need to know about, so you can approach the right leads, at the right time.

Book a demo today to see all of the key features of our platforms, as well as the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations that match your ideal customer profile.

Beauhurst Privacy Policy