The 6 Fastest-Growing Startup Sectors 2022

| Miriam James

Category: Uncategorized

Despite the coronavirus pandemic, many sectors experienced growth in 2021, especially those developing technology to make consumers’ lives easier. In particular, those businesses where people can make use of them whilst at home have flourished, like services-on-demand and edtech.

Sector growth can be measured in a multitude of ways. One way is to identify the sectors with the greatest growth in investment, which we’ve done here, calculated using announced equity rounds completed in 2020 and 2021, using our own sector matrix.

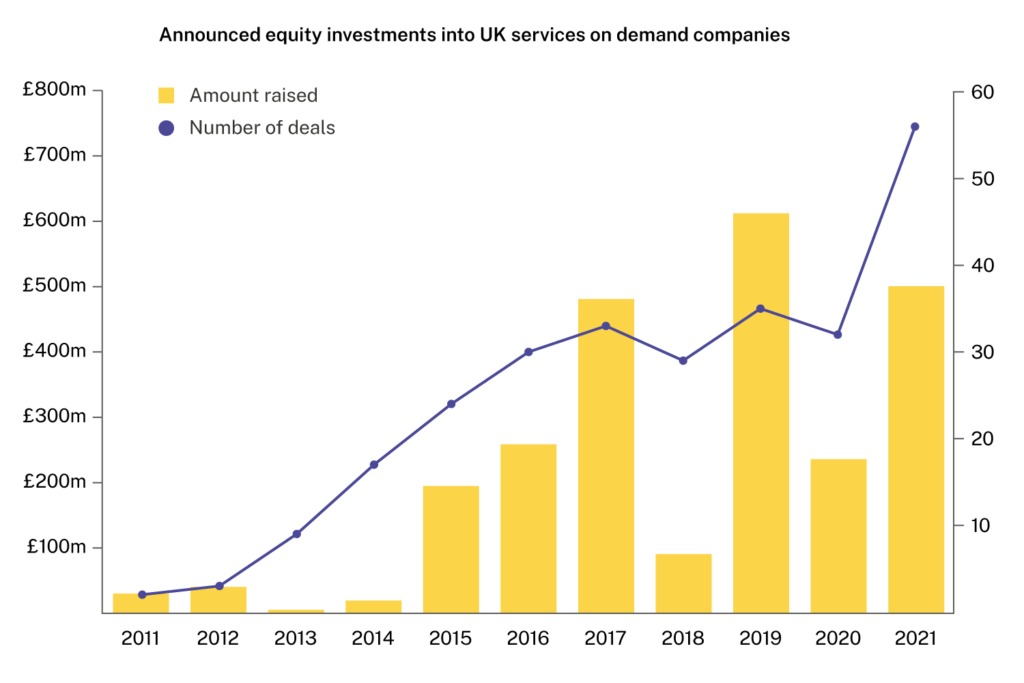

Between 2019 and 2020, we saw the rise of digital security, quantum computing, and crypto-currencies. In 2021, we had some new leaders: services-on-demand conquered the list, with the greatest increase in deal activity (growing 75% from 32 announced investments in 2020 to 56 in 2021), closely followed by edtech and proptech.

Here, we take a deeper dive into the six fastest-growing startup sectors in the UK, and explore the companies and investors at the forefront of innovation.

Services-on-demand

The UK’s fastest-growing sector is services-on-demand, which showed a 75% growth in the number of investment rounds between 2020 and 2021, from 32 to 56 rounds.

Services-on-demand allow customers to consume a service immediately, anywhere and anytime. These services can include IT, mobility, parcel collection and delivery, and workforce provision, among others. The growth of on-demand services has been driven by technological developments and changing customer requirements: customers have grown to expect instant gratification, thanks to companies like Netflix and Amazon.

192 of the UK’s active high-growth companies operate in the services-on-demand sector, which is becoming increasingly appealing to investors, due to the meteoric growth in demand during the COVID-19 pandemic. The public, in particular, are enamoured with the sector; crowdfunder Seedrs is the sector’s top funder, backing 37 deals from 2011 to 2021, whilst rival Crowdcube takes second place with 29 deals in the last decade. Index Ventures is the top venture capital investor, backing at least 13 deals in the sector.

It shouldn’t come as much of a surprise that all three of the sector’s top companies are in the on-demand grocery business, with the pandemic prompting huge demand for takeout and online grocery shopping. Dominating the sector is unicorn business Gousto, which has raised £271m to date. Founded in 2012, Gousto operates a meal kit delivery service, allowing customers to choose from over 60 recipes, including vegan and gluten-free options. Gousto will deliver correctly measured, fresh ingredients, along with an easy-to-follow recipe.

Not far behind Gousto is Zapp (which has raised £181m) and HungryPanda (which has raised £161m). Zapp delivers food and drink essentials, household products, and over-the-counter medicines, 24/7. Founded in 2020, the London-based startup company uses all electric vehicles and bikes to deliver items within 20 minutes, fulfilling impulse purchases and urgent needs.

Meanwhile, HungryPanda, which operates in nine countries including the UK and the US, feeds the demand for authentic Chinese food. It delivers food from both Chinese restaurants and supermarkets, and is currently the largest overseas Chinese food delivery company. Aimed at Chinese communities abroad, the app has a Mandarin interface for easy use.

Edtech

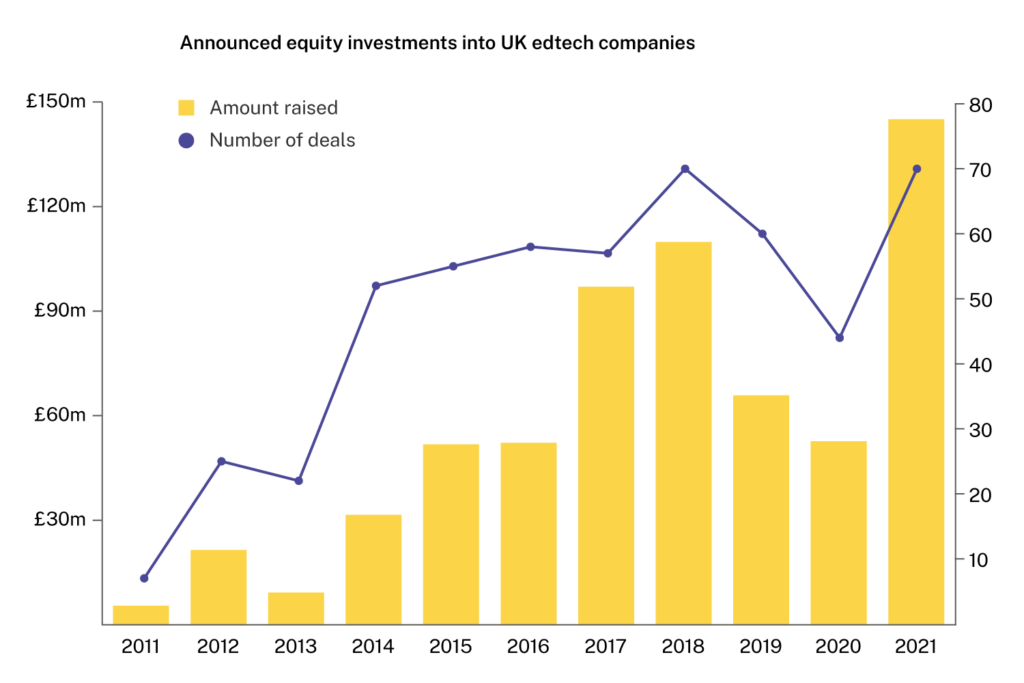

Edtech, or education technology, is the second fastest-growing startup sector in the UK. Edtech introduces tech tools into the classroom (or home) to create a more engaging learning experience. Edtech can help make education more accessible by opening up world-class academic resources to people around the globe, and making them available 24/7.

Again, the impact of Coronavirus encouraged the growth of the edtech sector, with teachers needing to find digital-first ways to educate students. 552 of the UK’s active high-growth companies operate in the edtech sector, the highest of all the industries in this list.

UK edtech companies secured 70 funding rounds in 2021, a 68% increase from 44 in 2020. Between 2011 to 2021, Scottish Enterprise has been responsible for the most deals, participating in 39 known rounds. Seedrs and Crowdcube are, again, high on the list of the decade’s investors, making 32 and 29 deals, respectively.

Kano is the edtech company which has raised the most equity to date, at £70.8m. It’s followed by Perlego, which has raised £55.6m, and Pi-Top, at £39.5m.

London-based Kano sells kits which allow kids to build and customise their own technology, such as computers and headphones. The idea originated from the founder’s 7-year-old nephew, who wanted to be able to build a computer as easily as he could create something from Lego. Kano was awarded the best product in the International Licensing Awards in 2019.

Perlego is an online library of academic resources and tools, allowing students to access them from wherever and whenever. Students pay for a subscription to Perlego, rather than buying each textbook individually, allowing them to save money over time. Perlego is available globally and enables academics to access over 800k professional titles, with a 14-day free trial for those who need a little convincing.

Along a similar line as Kano, Pi-Top sells DIY kits, including laptops. Customers can build these themselves, learning how to code and make the physical device. Pi-Top’s devices are powered by Raspberry Pi programming and include step-by-step instructions. Pi-Top also offers components to make compatible accessories, such as a microphone and LEDs, as well as the chance to make your own robot.

Proptech

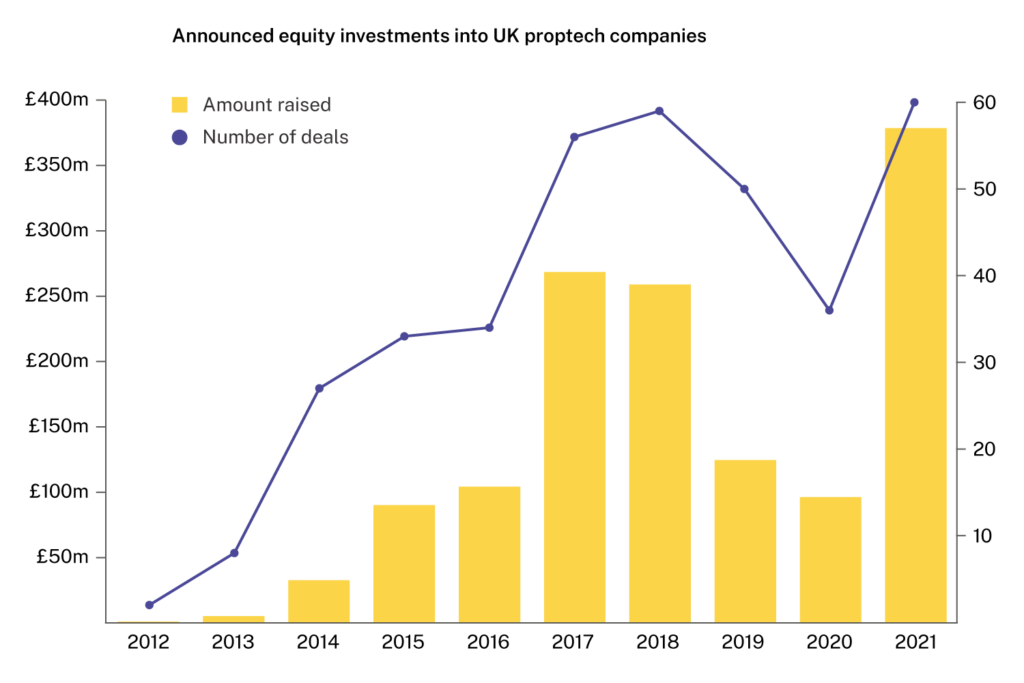

Despite seeing a decline in the number of funding rounds between 2019 and 2020, proptech saw a 67% increase in rounds between 2020 and 2021, ending on 60 rounds worth a combined £400m, the same amount as in 2018.

The original UK proptech, Zoopla, kickstarted the sector, which essentially uses technology and software to assist in real estate sales and operations. This includes using artificial intelligence (AI), automated processes, and 3D technology among others, to do a variety of tasks, making them easier and more efficient. Referred to by some as “the future of real estate”, the sector is booming, with 306 active high-growth UK companies at the time of writing.

Seedrs and Crowdcube are the sector’s top investors, with 70 and 25 deals completed from 2011 to 2021, respectively. Pi Labs, a venture capital fund dedicated to backing proptech firms across Europe, is the next highest investor, with 18 known deals completed in the UK during the decade.

The UK proptech industry’s top company is Nested, which has raised £171m to date. Nested is the only estate agent built specifically for buying and selling at the same time, and is the first and only agent to make sellers chain-free. Nested’s own chain management specialists deal with the progression of its customers’ sales, so they can move faster. Nested lists its properties on Zoopla and a variety of other sites, such as Rightmove.

Causeway, which provides software to power the design, build, operation and maintenance of the built environment, has raised £120m so far. It offers an expanding range of cloud solutions, smart development tools, and a supply chain network, with software to meet the demands of professionals, contractors, suppliers, and owners. For example, landlords can monitor maintenance lifecycles with a cloud-based condition survey tool.

With £107m raised to date, London-based Plentific is also making waves in the proptech industry. Plentific provides software-as-a-service (SaaS) for landlords and property managers to manage their properties, as well as a marketplace made of local trade talent, who can provide repairs and maintenance. Over 800k properties across the UK, US, and Germany are managed with Plentific.

Alternative Finance

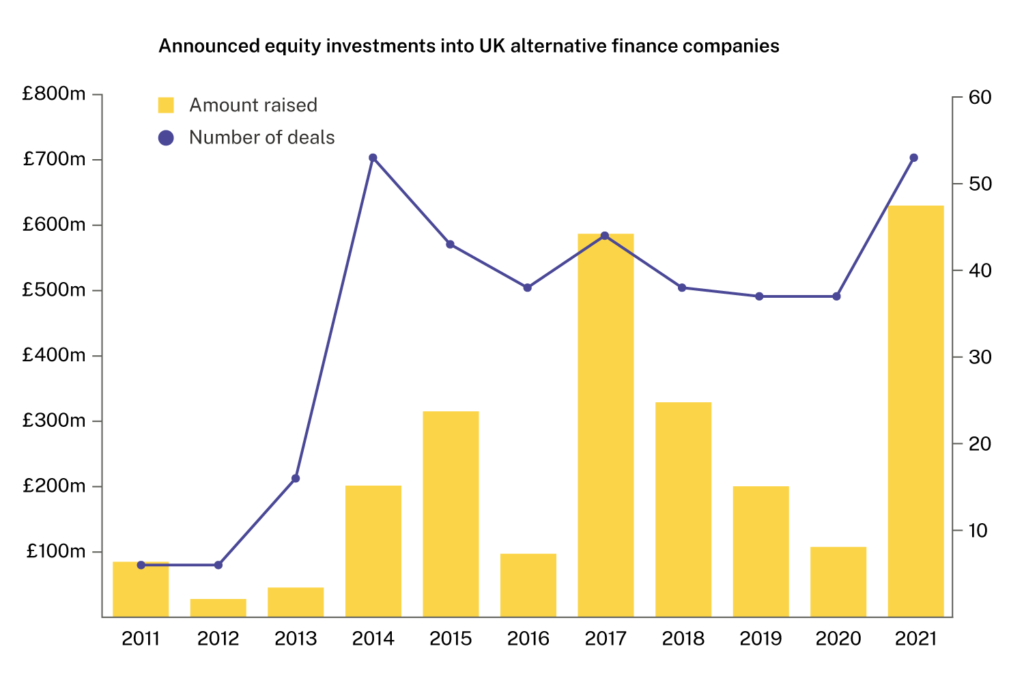

Alternative finance (or altfi) describes any type of business finance which doesn’t come from a mainstream provider such as a high-street bank, covering a wide variety of financing solutions. Traditional financing methods aren’t always suitable for businesses; a 2019 survey found that two-thirds of younger businesses chose alternative finance over banks. Now, 210 of the UK’s active high-growth companies operate in this sector.

In 2021, alternative finance companies secured 53 funding rounds, showing 43% growth from 2020. In the last decade, Seedrs has become the top investor into alternative financial services, backing 94 deals out of the sector’s total of 371. Crowdcube has backed 21 deals, and the Future Fund has made 12 deals into the sector.

The top company in the alternative finance sector is Atom, which has raised £597m to date. Built by investment professionals, Atom’s mission is to empower people to make informed investing decisions using the best software and data. Founded in 2018, this leading fintech company operates an investment platform, offering several layers of data, resources, and analysis to institutional and retail investors. Its platform is customisable and curates the research experience to the user’s needs.

Just behind Atom, Zopa has raised £516m so far. Zopa began as a peer-to-peer (P2P) lender, allowing ordinary investors to lend cash to other credit-checked individuals or businesses to fund their plans. In 2020, Zopa was granted a banking licence and moved towards more traditional lending. It also launched Zopa Bank, a challenger bank, which gives customers the option to open a savings account and use a credit card. Zopa recently became a profitable company, becoming one of the fastest digital banks to do so.

Lendable has raised £217m so far, coming in third in the ranking of top-funded alternative finance companies in the UK. Formed in 2014, Lendable’s founders decided that getting a loan shouldn’t be a complicated or lengthy process. The Lendable platform harnesses technology and data to make personal finance hassle-free and customer-friendly, boasting speed, simplicity, and service. Loans can be requested through a simple application and, once approved, funds arrive within two hours. Lendable’s customer service is available seven days a week.

Insurtech

Combining ‘insurance’ and ‘technology’, insurtech refers to companies using technology to drive innovation in the insurance industry. 174 high-growth companies are currently active in the UK insurtech industry.

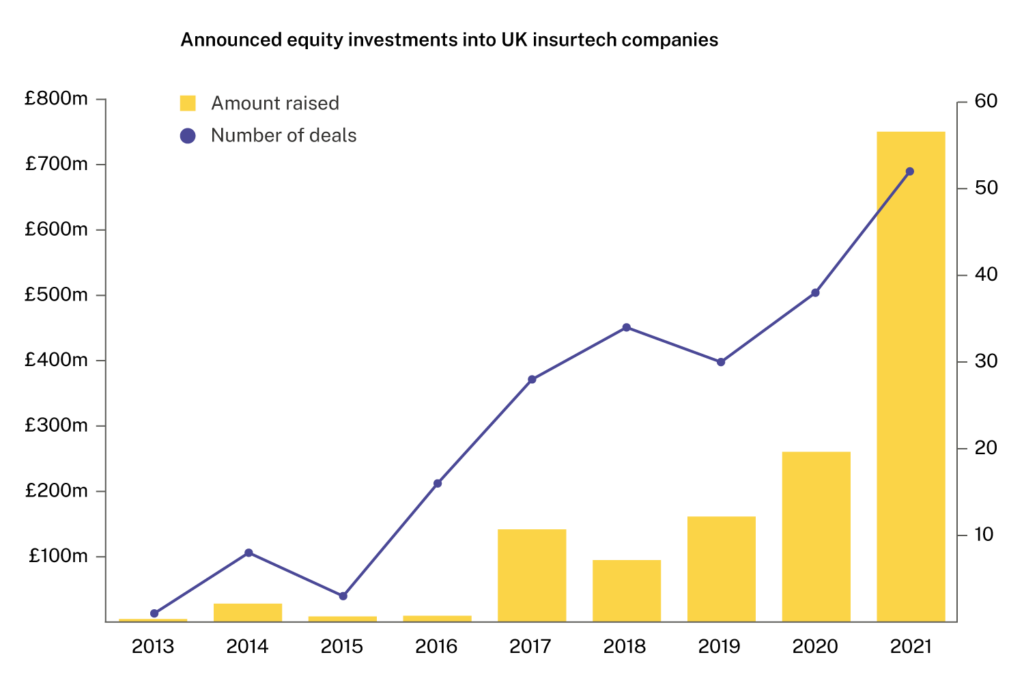

Insurtech companies secured a total of 52 funding rounds in 2021, up 37% from 2020. With the sector having seen 158 fundraisings in total from 2013 to 2020, the growth in 2021 indicates a substantial increase in investor interest, and a maturation of the market.

Not only has the total number of fundraisings increased since 2013, the total value of fundraisings has made a massive leap from just over £200m in 2020 to over £700m in 2021.

Seedrs is the top investor into UK insurtech companies, backing 20 deals between 2011 and 2021—almost 10% of the total 210 fundraisings. InsurTech Gateway, another top investor, has made 15 deals into insurtechs since 2011.

Unicorn firm Bought By Many is the top company in this sector, having raised £357m so far. Bought By Many provides pet insurance, priding itself on how it listens to cat and dog owners to create its policies, offering up to £15k in lifetime vet fee cover with a multi-pet discount for pets on the same policy. The company was awarded the Pet Insurance Provider of the Year by Moneyfacts in 2021.

Zego and Marshmallow follow Bought By Many, having raised £210m and £90.1m, respectively. Zego provides vehicle insurance for businesses, both for sole traders and global corporations. Since 2016, Zego has insured over 200k vehicles, providing an alternative to traditional insurance, which the founders believe holds businesses back. Zego partners with many food delivery services, like Uber and Deliveroo.

Marshmallow also provides vehicular insurance, specifically for cars. It supports UK newcomers and expats, and people who are unemployed or without a credit history. The founders believe that traditional insurers mistreat these people, judging them based on outdated systems. Marshmallow became a unicorn company in 2021—Britain’s second unicorn to have been created by black founders. It is also one of just two UK insurtechs to have secured an insurance licence.

Gamification

The last of the fast-growing sectors in this list, gamification refers to the process of adding game mechanics into non-game environments to increase participation. The goal of gamification is to engage with consumers, employees, and partners to inspire collaboration, share, and interact. There are currently 199 high-growth companies innovating in this space in the UK.

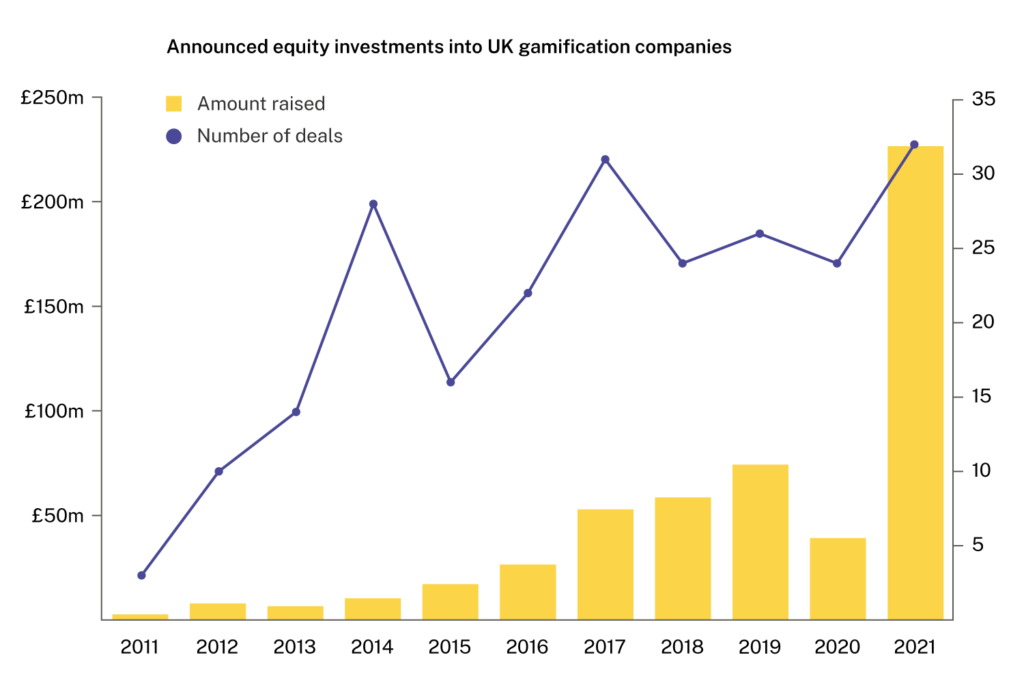

Like insurtech, the gamification sector has seen huge increases in funding activity since 2011. Companies in the industry completed 32 deals in 2021, up 33% from 2020, and marking over 10% of the sector’s total 230 fundraisings since 2011. The total value of fundraisings has more than quadrupled, from under £50m in 2020 to over £200m in 2021. Seedrs has backed 20 of the sector’s 230 deals, while Crowdcube has made 14. SyndicateRoom is the next top investor, with nine deals over the last decade.

The top company in this industry is Immersive Labs, which has raised £91.9m to date. Not far behind is YuLife, with £63.7m of equity raised, and Yoyo, with £49m. Immersive Labs provides an interactive training platform, which changes the way businesses approach cyber-awareness. Its Cyber Workforce Optimization is a SaaS platform which includes ‘labs’, offering games which give users cyber-security scenarios. Immersive Labs was featured as one of Comparably’s Best Companies for Happiness in 2021.

Merging life insurance with gamification, YuLife transforms traditional insurance and employee benefits into life-enhancing experiences, with a package of preventative health benefits. YuLife offers tangible rewards for healthy behaviour: customers can earn ‘YuCoins’ for every 2,000 steps and every five minutes of mindfulness, as well as from various quests, encouraging healthy competition. YuCoins can then be redeemed for rewards.

Yoyo is aimed at businesses, allowing them to strengthen their relationships with their customers through digital loyalty and reward solutions. It offers several custom-branded loyalty apps, including Yoyo Pro, Yoyo Go, and Yoyo Wallet, which can include prize draws. Caffè Nero’s loyalty app is powered by Yoyo and saw huge growth when it was first launched, with an extra 50% in total sales.

With the world beginning to recover from the pandemic, these sectors are leading the way, contributing much-needed growth to the UK’s economy.

Transform your sales strategy in 2022.

Get access to unrivalled data on all the companies you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo today to see all of the key features, as well as the depth and breadth of data available on the Beauhurst platform.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.