11 Early Stage Tech Startups Growing Through COVID-19

| Beauhurst

Category: Uncategorized

Early stage startups are usually high-risk ventures, initially unprofitable, and far from being market-ready. Equity funding is often crucial for them to scale and grow.

With serious disruption to revenues and cash flow during COVID-19, equity finance has proved a lifeline for a number of high-potential businesses. But it has also become harder to come by, with investors choosing to put money into existing portfolio companies, instead of taking on new risk. It follows that, as a proportion of all announced investments, first round fundraises dropped to a new low in Q3 2020. So far, it seems that Q4 is following a similar trend, with plenty of investment activity for later stage companies, but little for those in the riskiest stages of growth.

Against the odds, 195 UK companies raised their first equity investments during the pandemic—inspiring long-term investment during a time when short-term concerns are paramount. Of these, 145 are tech-based startups. In this list, we’ve hand-picked some of the most promising seed stage tech startups that have raised their first round of equity finance since April 2020.

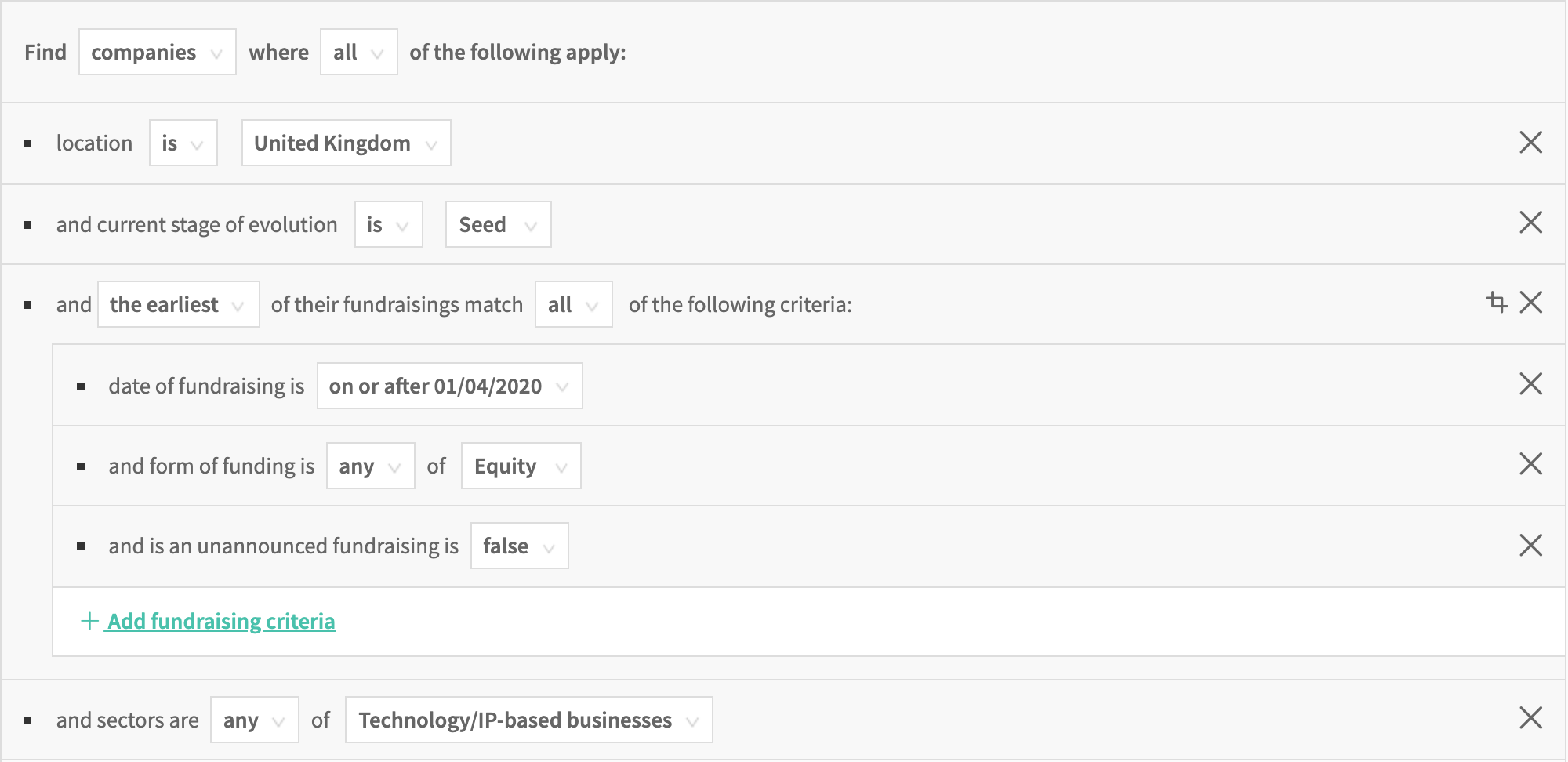

You can see the whole list of companies on the Beauhurst platform. Simply use this search:

11 seed stage tech startups growing through COVID-19

1. Heroes

Founded: 2020

Location: Islington

Funds raised: £49.7m

Heroes is an e-commerce company that acquires, operates, and grows SME companies trading on Amazon—also known as ‘Fulfilment by Amazon’ (FBA) businesses, which generated £196b as a worldwide ecosystem in 2019. It identifies the companies on Amazon with proven business models, financial success, and stellar customer reviews—particularly where product-market fit has been established and capital for growth is needed.

Heroes audits FBA business’ Amazon sales information, product costs, and assess the total profitability. It then makes the company an acquisition offer based on its valuation. The FBA small businesses they acquire range widely in sector, from DIY and homeware to sports and pets companies.

The company, which is based in Islington and was only founded in May 2020, secured a staggering £49.7m in its first investment round in October. The investment was a mixture of equity and loan fundraising and came from Fuel Ventures, 360 Capital Partners, and Upper90. Two angel investors also participated in the round: Matt Robinson and Carlos Gonzales, both ex-GoCardless. This is the third-largest first investment into a seed stage company on record, behind only Proton Partners International and Metro Bank (both of which have now IPO’d).

Brothers Riccardo—an ex-investor at EQT Ventures—and Alessio Bruni co-founded the company, and have previously co-founded high-growth eHealth startup Many in 2018 with Nicholas Loryand. Heroes has just under 20 employees to date, and is ramping up hiring on the back of its colossal investment round. Moving forward, the brothers are looking to become Europe’s largest acquirer and operator of Amazon FBA businesses.

2. Clim8 Invest

Founded: 2019

Location: Hammersmith and Fulham

Total funds raised: £4.50m

Clim8 Invest has developed a digital investment platform specialising in truly green, sustainable companies. Based in Hammersmith, the company is working to make a positive impact on climate change by facilitating investments into companies fighting it. Core themes are sustainable food, smart mobility, cleantech and recycling.

This company has an impressive track record so far. Since Duncan Grierson founded Clim8 in summer 2019, it has raised three rounds, totalling £4.50m. One round for £635k in December 2019, a round of £1.3m in April 2020, and one for £2.5m in November 2020.

A range of private investors including Marcus Exall (Monese) and Marcus Mosen (N26), plus PE executives and investment bankers from Deutsche Bank, Morgan Stanley, and Goldman Sachs were first to invest in the company. Crowdcube followed after this in the April round—involving 1400 retail investors from 55 countries—highlighting the appetite for more accessible sustainable investing even during COVID-19.

The second round was also joined by the Clim8 Invest’s first institutional investor, 7 Percent Ventures—a £30m seed fund backed by the British Business Bank and Atomico. The third round was largely from Crowdcube again (from 1800 retail investors this time) and included particpation from 7 Percent Ventures (follow-on), Basil Capital, EcoSummit Ventures, Evergreen Fund and several ex-McKinsey partners.

Recently a HSBC report found that shares in environment, social, and governance (ESG) companies outperformed other portfolio companies by 7% throughout COVID-19 (since February).

Clim8 currently employs just over 20 people and is actively expanding. The platform launched in beta in September and has starting onboarding users from its waiting list of over 13,000 people.

3. Universal Quantum

Founded: 2018

Location: Cambridge

Total funds raised: £3.60m

Universal Quantum develops quantum computing technology. This Brighton and Hove-based startup was founded by Sebastian Weidt and Winfried Hensinger in 2018, and spun-out from the University of Sussex. The company is racing major tech giants to engineer the first successful large-scale quantum computer.

The core appeal of quantum computing is that it can tackle problems that are beyond even the fastest of supercomputers. Quantum Computing could supercharge real-world applications, such as pharmaceutical discoveries, or improving atmospheric modelling to analyse climate change.

Universal Quantum’s technology differs in the way it uses trapped ions (charged atoms) rather than laser beams—which are commonly used in quantum computing—to power silicone microchips, mimicking microwave technology. This reduces the cooling requirements and operating temperature, making its technology more practical and scalable than other approaches.

The company raised its first equity round of £3.60m in June, with participation from 7Percent, Hoxton Ventures, Luminous Ventures, Propagator VC, and Village Global. It was an oversubscribed round—meaning more capital was committed by backers than the company intended to raise—highlighting the interest generated by this startup. The seed round will be used to further develop its technology, locate a permanent site, and continue hiring talent.

4. Spark

Founded: 2018

Location: Hackney

Total funds raised: £3.50m

Spark is a carbon investment platform, founded in 2018 and based in Hackney. It was created by clean energy and technology executives, and aims to shrink the world’s carbon footprint by incentivizing CO2 reduction. Unlike Clim8 Investment, users on Spark do not invest directly in green ventures—but instead purchase carbon allowances, which corporations need to offset their pollution.

The supply of carbon emission allowances is reduced every year, creating legislative pressure and increasing the cost of polluting for corporations. Through investment in carbon markets, users further reduce this supply and drive the price of carbon allowances—and therefore of pollution—upwards. This encourages emitters to switch to greener solutions and reduce their greenhouse gas emissions. Spark estimates that carbon allowance prices must reach $50-$100 per tonne of CO2 to achieve the goals of the Paris Agreement.

Spark attended the Barclays Techstars Accelerator and has secured £3.50m in investment from Barclays Ventures, Finlab AG, Librae Holdings, Solactive AG, Swing Ventures, and TechStars Ventures. The company has offices in London, Seattle, and Boston. Its ultimate goal is to offset 1b+ tonnes of emissions.

5. Living Optics

Founded: 2019

Location: Oxford

Total funds raised: £3.30m

Living Optics is a spinout company from the University of Oxford physics department. Founded in 2019 by Robin Wang, the startup develops technology focussed on “hyperspectral” imaging. Essentially, this allows us to see more spectral content in a pixel than the human eye or digital camera can. By combining hyperspectral imaging and computer vision, you can see what is usually invisible—one can identify greenhouse gases, quantify water content, check the health of plants, and even measure blood oxygenation.

The company secured its first fundraising in April for £3.30m. Foresight Williams Technology EIS Fund and Oxford Sciences Innovation funded the round in exchange for a 48% stake, resulting in a £3.54m pre-money valuation.

Moving forward, the company is focussing on scaling and commercialising its technology, to bring hyperspectral imaging to mainstream markets as a low-cost, fast, and compact camera product.

6. Northflank

Founded: 2019

Location: Hackney

Total funds raised: £2.08m

Founded in 2019 and based in Hackney, Northflank develops custom cloud integration software for businesses and developers. The company is working on its DevOps platform entirely in the cloud, where users can run microservices, processes, and databases via one interface. This centralises and streamlines the DevOps workflow into one cloud-based platform, allowing complete integration of software and tasks—from previewing code, releasing changes through a Dockerfile, and submitting to Github.

The company raised £2.08m in equity fundraising from venture capital firms Amaranthine Partners, Kindred Capital VC, The Family Capital, and Stride VC. Just over 10 employees work on the platform, completely remotely and across the world. The company is using its seed funding to further develop the Northlank platform, expand its operations, hire talent, and to scale into additional regions. It is currently in live beta, and anyone can sign up to request access here.

7. Raycast

Founded: 2020

Location: Trafford

Total funds raised: £2.08m

Raycast develops software which enables developers to access, prioritise, and control their tools, tasks, and programs. Raycast is one of many UK-based workplace SaaS tools growing throughout COVID-19—including larger-scale companies like Wagestream, Onfido, and Ripjar—in response to social distancing and accelerated digitalisation.

Raycast is a Mac-only tool that works in a similar way to MacOS “spotlight”, allowing developers to work across multiple platforms, seamlessly integrating and automating workflows. The goal is to simplify developers’ tech stack. You can complete processes within Raycast—like joining a Zoom meeting or extracting GitHub requests—without navigating through the applications. Overall, it makes developers more productive.

Petr Nikolaev founded Raycast at the beginning of 2020. The company secured its first fundraising in October 2020 for £2.08m from Accel, Chapter One Ventures, and YCombinator.

The company is located in Trafford, Greater Manchester, and has just four employees so far. The Raycast beta is currently open to its 100,000-strong developer community in exchange for feedback and testing.

8. PharmEnable

Founded: 2016

Location: Cambridge

Total funds raised: £1.80m

PharmEnable develops a platform that searches through a virtual database to find new chemical molecules, which in turn can be used to develop new medicines. It uses medicinal chemistry and algorithmic approaches to drug discovery—particularly seeking efficient, small molecule drugs for “undruggable” conditions.

Hannah Sore founded the company in 2016, spinning out from the University of Cambridge. The company remains headquartered in South Cambridgeshire and has attended the KQ Labs and Accelerate Plus accelerators since then.

PharmEnable raised its first fundraising for £1.80m in May 2020. Investors include Access EIS, Martlet Capital, o2h Ventures, The University of Cambridge Enterprise Fund, and Wren Capital. Like Universal Quantum’s first investment, this was a significantly oversubscribed round. The company will use this funding to run several drug discovery programmes, specifically targeting drugs for cancer and neurodegenerative diseases.

9. Deep Render

Founded: 2017

Location: Tower Hamlets

Total funds raised: £1.58m

Deep Render develops media compression artificial intelligence software. Arsalan Zafar and Chri Besenbruch founded the company in 2017, spinning out from Imperial College London. The pair founded Deep Render to solve the world’s growing data consumption demand; our global demand for data doubles every two years.

Based out of Tower Hamlets, the company is using proprietary machine learning technology to reinvent the process of compression, rather than building upon the current process. By mimicking the neural processing of the human eye, the algorithm targets pixels that our eyes pay most attention to, which reduces file sizes while maintaining visual quality. Ultimately, Deep Render aims to increase compression efficiency by a factor of ten.

The company raised its first equity investment in May 2020. Pentech Ventures and Speed Invest supplied the funding, which totalled £1.58m, at a pre-money valuation of £4.97m. The investment will be used to further product development and hire talent.

10. Cado Security

Founded: 2020

Location: Camden

Total funds raised: £1.50m

Cado Security develops cloud-based cyber security software that enables users to analyse threats, detect malware, and monitor suspicious events. The Camden-based startup was founded in April 2020.

Its leading product, Cado Response, is currently in beta and only select customers have early access. The unique proposition of Cado’s offering is that it specialises in cloud-based security—it is the first cloud-native security and response platform. Cado also offers a suite of other tools, such as Cado Live, which makes a forensic copy of your local disk drive and sends it onto cloud storage.

Cado Security raised its first investment just seven months after inception: £1.50m from TenEleven Ventures in November to hire talent, particularly to grow its development team.

11. PSYKHE

Founded: 2019

Location: Westminster

Total funds raised: £1.33m

PSYKHE develops a fashion e-commerce platform that uses artificial intelligence to provide recommendations. Clients take a personality traits test, which is then parsed by algorithms to match up favourite brands and products with options “matched to your personality”. Each user sees a different store page and different products while shopping, informed by their traits, previous purchases, and interests.

Founded by Anabel Maldonado—a freelance fashion journalist with an education in psychology—the product has been developed so that clients can even filter results by mood, create wish lists, and tune results to train their personal algorithm.

The seed stage company is based in Westminster and was founded in 2019. It has just five employees to date, but has secured £1.33m in equity fundraising. This investment was raised in exchange for a 7% stake from Carmen Busquets and SLS Journey (a new investment arm of MadaLuxe Group). PSYKHE will use the funds for scaling its AI-driven technology and expanding into other consumer markets.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.