How Business Valuations Have Changed Since COVID-19

| Hannah Skingle

Category: Other

Business valuations are always tricky to determine, but never more so than in times of crisis.

Valuation methods typically rely on predicted future earnings, EBITDA and cash flow. Projections are rarely accurate, but are even more tricky to establish during the pandemic because we have very little idea of what the continued impact will be. How long will lockdown and social distancing measures last, and how long will the recession endure beyond that?

Public markets have already suffered huge blows, with stock prices dropping up to 25% in the first half of the year, and we may well expect to see a larger dip later down the line if there’s a significant resurgence in covid cases.

All of this volatility and uncertainty means that business owners (who want a high business value) and investors (who want a lower business value) will have an even harder time establishing and agreeing upon a fair market value.

In this post, we’ve analysed the data to see how private company valuations have been impacted by the pandemic, and how trends have changed over time.

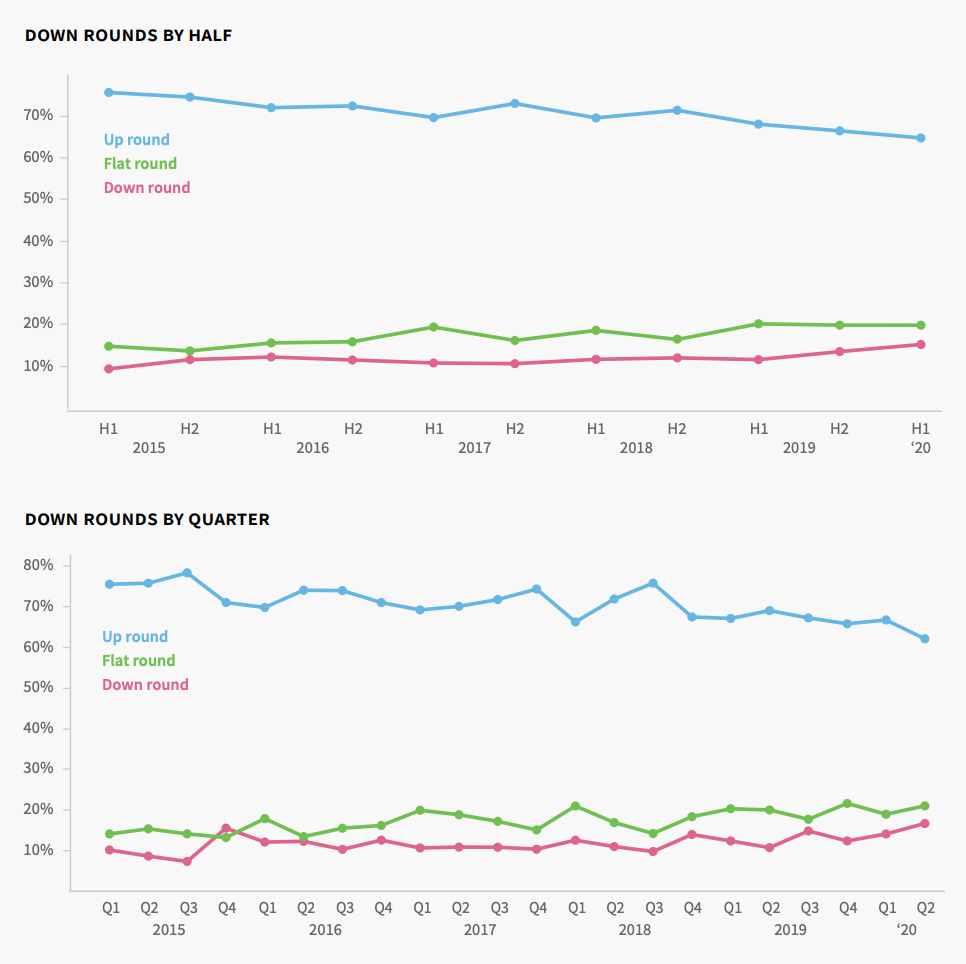

The number and proportion of down rounds is increasing

Challenger bank Monzo notoriously suffered a 40% downround in June, insisting that this came entirely as a result of the pandemic. The £60m round saw the unicorn’s valuation drop from a reported £2b in June 2019, to a reported £1.24b. Our analysis shows that the company’s valuation is closer to £1.04b.

Monzo wasn’t the only one to experience a down round this year. As we found in our most recent Equity Market Update, H1 2020 saw both the highest number and proportion of down rounds on record. 15% of announced deals with valuation data (66) were completed at a lower company valuation than the recipient’s previous funding round.

But this figure is still fairly reasonable. The rise is in keeping with the existing trajectory of down rounds, with a single percentage point increase from H2 2019 and three percentage point hike from H1 2019. This may be worrying for its own reasons, but it at least suggests that coronavirus hasn’t had too much of an impact on down rounds—yet.

The average value of UK businesses is still on the rise

The average valuation of private companies actually reached a record high in Q1 2020, at £37.6m. This figure declined as we moved into Q2, ending on £24.2m Still, this figure beats the average company valuation throughout 2019, bar Q2 when it was £24.9m. This is good news for the UK’s high-growth businesses. Variation between quarters is normal, and the graph is still very much upwards and to the right.

A meteoric boost at the Growth stage of evolution

But how does this look for companies in different stages of growth? Our data shows that it was growth stage companies that drove the meteoric rise in value in Q1 2020; achieving a record £258m. That’s 1.7x the next highest on record, which was in Q3 2018. This figure decreased to £133m in Q2 2020 — still the third highest average to date.

Small businesses in the earlier stages of evolution saw less drastic change, but an increase nonetheless. The average pre-money valuation for seed stage businesses was £3.57m in Q1 2020, compared with £3.3m in Q1 2019, and £3.02m in Q2 2020, compared with £2.92m in Q2 2019.

The average pre-money valuation for venture stage businesses was £9.64m in Q1 2020, just shy of the average of £10.8m in Q1 2019. These businesses achieved the second highest average valuation on record in Q2 2020 at £13.7m. This compares with £9.61m in Q2 2019.

Have you read our latest report on equity investment trends in 2020?

The largest business valuations in 2020 so far

Whilst Monzo suffered its 40% down round in June, competitive bank Revolut secured a £62.4m round in July, at a £5.1b pre-money valuation. This marks an increase of 2% from its previous post-money valuation in February — a small, but positive change — which technically makes this a ‘flat round’.

Oxford Nanopore Technologies has raised three rounds of funding in 2020, two of which were completed after lockdown measures were put in place. It was the company’s first round of the year, in early January, that saw it valued at its highest pre-money figure of £1.79b. The round that followed in May was an 11% down round, taking the valuation back down to £1.62b pre-money. It’s not clear what valuation was achieved in its latest raise of £529k in July.

CMR Surgical secured a £1.14b pre-money valuation in its £750k fundraising in March. It looks as if this was a flat round, completed at a similar valuation to its £195m round in September last year.

Closing thoughts

There have been some notable down rounds during 2020, and even the most valuable high-growth businesses aren’t exempt. Still, so far coronavirus has had very little impact on business valuations as a whole. We’re interested to see how these trends change over the remainder of the year.

As Craig Blackmore, Director of Verde Corporate Finance notes: ‘This is an area where we continue to step into the unknown. As time goes on, monitoring market activity will be key to determine whether the pandemic was a bump in the road or now presents a whole new set of potholes’.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.