Healthtech in the UK: can startups rescue the NHS?

| Beauhurst

Category: Uncategorized

A recent report by the Institute for Fiscal Studies suggests that by 2061, healthcare spending in the UK could consume around 12% of the country’s GDP – compared with around 6.8% in 2016/17. In this post, we look at some of the UK’s leading healthcare and medtech startups that could help relieve some of that pressure on the NHS, now and in the future.

Cera for social care

Cera, a provider of home care to vulnerable people in the UK, has been building up quite a buzz since launching in November 2016 as a sort of ‘Uber for care’. Elderly people (or rather, their families) in need of extra support sign up to the web-based service, indicate their specific needs, and are then presented with a curated short-list of carers who match their requirements. Their services can then be booked on-demand.

*Cera shares significant shareholders with Beauhurst.

Earlier this year in March, they actually signed a partnership with Uber, and their combined service now manages the homecare requirements of the Barts Health NHS Trust in East London.

The company has already picked up £3.4 million through 4 equity fundraisings, with past investors including David Buttress, the CEO of Just Eat, and Thomas Zeltner, the former vice-chair of the World Health Organisation. It has also attended two accelerators – Digital.Health London in 2016, and PwC’s Future of Health in 2017.

On an interesting side note, Cera’s founder Dr Ben Marathappu attended Haberdashers’ Aske’s Boy’s School just a few years above Herman Narula, the CEO and founder of Improbable, a British VR unicorn that recently received $500 million from Japan’s SoftBank.

App innovation

Other companies are looking to mobile apps to improve the healthcare system. Locum’s Nest is a great example – their app links doctors to temporary vacancies in the NHS, cutting out the expensive, cumbersome locum agencies that stirred up a bit of controversy earlier this year.

To this end they recently received £1.1 million from Albion Capital and IDO Investments, which they are currently using to help roll out their service nationwide.

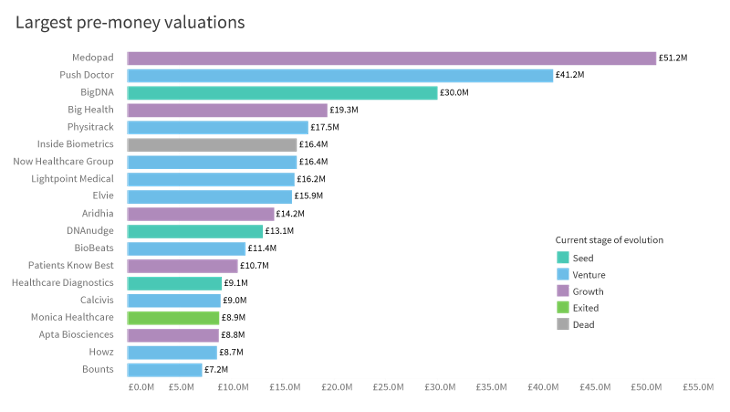

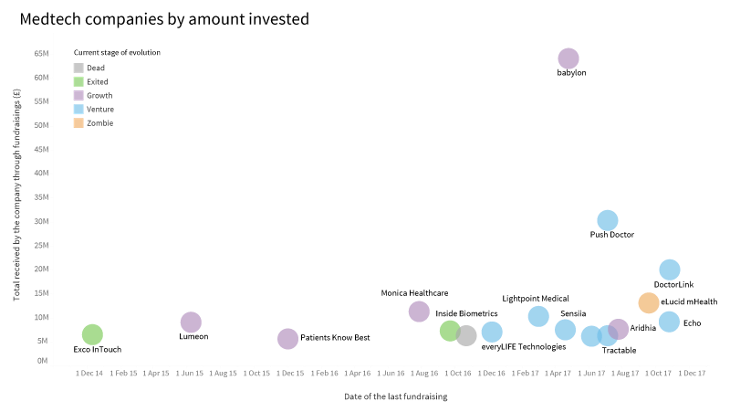

Whilst Cera and Locum’s Nest are both still in their infancies, several other British health tech companies have progressed much further, both in terms of fundraisings and revenue. Push Doctor and babylon, two competitors, have developed apps that allow patients to receive consultations from qualified medical practitioners through online, Skype-like video calls. In the 3-4 years since they launched, both have got off to impressive starts, with babylon now officially partnered with the NHS (and being trialled across London).

Manchester-based Push Doctor has won £30.3 million through 4 rounds of fundraising, whilst London’s babylon boasts nearly double this, with £64.1 million raised from just 2 rounds.

The most recent ($60 million equity in April from Vostok New Ventures and the Sawiris family) gave them a valuation of nearly $200 million.

In the 2015/16 financial year, babylon more than tripled its turnover to £946k, and, at just over 3 years old, has already managed to turn a profit. That’s no mean feat for a young startup.

Both Cera and babylon are looking to develop greater AI capabilities for their respective services, in the hope that their apps will one day be able to offer patients full diagnoses without input from a human.

In January, babylon won a trial with several London health authorities, whereby their early-stage AI chatbot would replace the NHS’s telephone helpline for non-emergency enquiries. As machine learning and artificial intelligence technology become more sophisticated, the scope for these platforms to cut costs in the NHS is considerable.