What Are Unannounced Fundraisings & What Can They Show?

| Hannah Skingle

Category: Uncategorized

An unannounced fundraising is simply an investment made in to a private company that is not announced to the public. These transactions are an integral part to understanding the beginnings and continued growth of some of the largest companies in the UK. Deliveroo, BenevolentAI and Wise, some of the UK’s most valuable private companies, all started their funding journeys with unannounced raises.

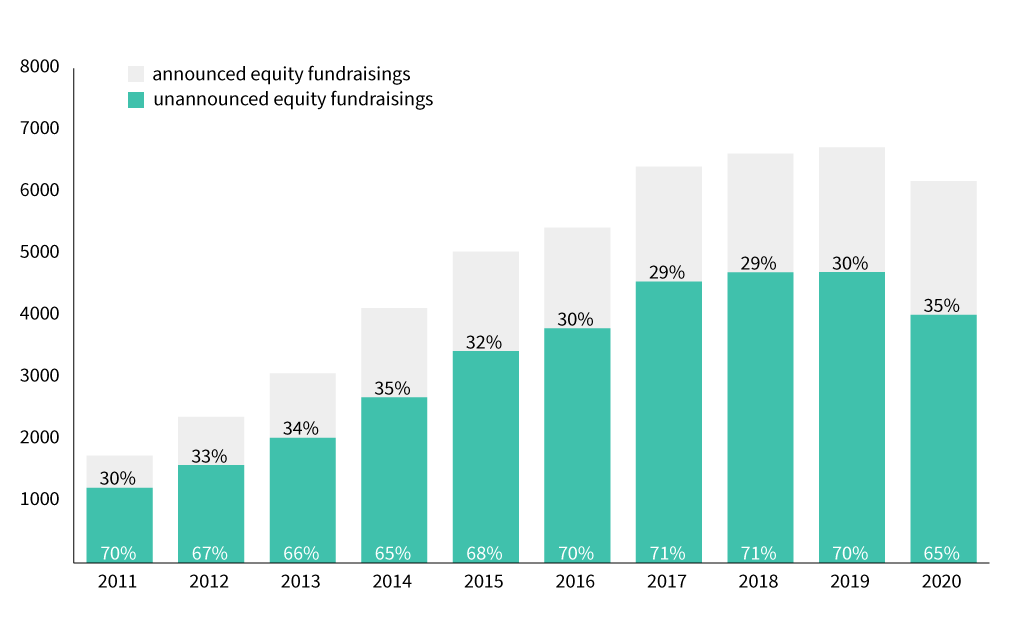

We currently track over 7,300 companies on the Beauhurst platform that have raised equity funding and never announced it to the public. In 2020, 65% of equity deals were not announced to the public, and there have only been small fluctuations in this figure since 2011. In terms of pounds invested, however, 73% were announced.

Although under-the-radar funding rounds are, on average, significantly smaller than those shared with the media, they can be just as interesting—if not more—and signal that a much larger event is on the way. You can check out our 2020 report, The Stealth Round, for further information on unannounced fundraisings.

Key findings 2011 – 2020

Number of unannounced deals

Number of announced deals

average deal size

Average deal size

How do we source this data?

Beauhurst is the only data provider to have comprehensive and structured coverage of unannounced investment deals in the UK. Using proprietary technology, we monitor all SH01s (forms that companies submit when they wish to issue new shares) filed to Companies House. Sometimes, these may not show genuine investment, so we’ve built an algorithm to pick its way through the minefield and flag up any filings that do. Then, a member of our in-house Data team investigates and verifies if a new investment has been made, and uploads the data to the Beauhurst platform.

SH01 filings may not show genuine investments for several reasons, such as the exercise of employee options, restructuring shares to make the capitalisation table look tidier for accounting purposes or because the company paid for services in shares, rather than in cash.

Why might a company want to keep their funding under wraps?

On the one hand, a company may choose to announce their fundraising as it’s an exciting achievement worth celebrating, and acts as an external validation of its ambitions. This may result in increased press coverage, and hence lead to new business or opportunities. An equity funding round is a particularly notable event if it includes participation from high-profile funds, such as Accel, Index Ventures or Octopus Ventures.

It’s also worth noting that some rounds need to be announced to the public. For example, almost every round that’s completed via crowdfunding is announced (and in some cases, very heavily publicised, like Citymapper’s recent raise via Crowdcube).

On the other hand, a business may choose not to announce their fundraising for a number of reasons:

- The company lacks the resources to successfully promote their raise to the media

- The company doesn’t think it’s relevant to promote the funding round

- The company is hiding a down round—an investment deal in which shares are sold for a lower price than in the previous funding round

- The company is in “stealth mode” and trying to stay under the radar

- The funding round is a precursor to a more significant event, such as an IPO, crowdfunding round or large investment deal that the company doesn’t want to hint at

Investment numbers

Even though the number of equity deals completed in the UK has increased significantly since 2011, the percentage share of unannounced fundraisings has remained fairly steady, fluctuating between a low of 65% in 2014 and a high of 71% in 2017 and 2018. This indicates that filings are not disclosed to the media for systemic reasons, rather than being swayed by the economic climate.

In 2020, just 65% of deals went unannounced to the public, but this figure may rise as late filings are submitted to Companies House.

total Number of UK equity deals and percent unannounced by year

Investment stages

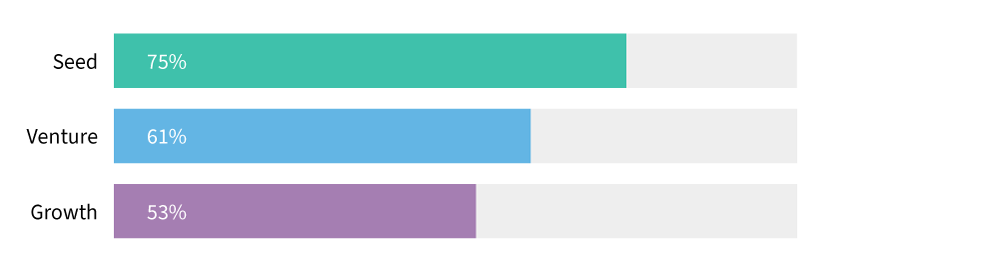

As expected, Seed-stage companies have a higher proportion of unannounced fundraisings than those at Venture or Growth stage; the larger the funding round, the more likely it is to be announced to the public. Companies in the Seed stage may not yet have the means or desire to announce their investment rounds, and might be more private about raising capital whilst they focus on research and development. A more mature company is likely to have a higher level of public interest in their funding rounds, and more inclined to be open about their funding success.

Even within Growth-stage companies, however, the majority of deals are still filed discreetly. Perhaps these fundraisings are less newsworthy (if they simply show continued support from previous investors), are concealing a down round or financial difficulty, or are helping to finance an IPO that the company is yet to announce.

Percentage of deals that are unannounced by stage of evolution

Sector focus

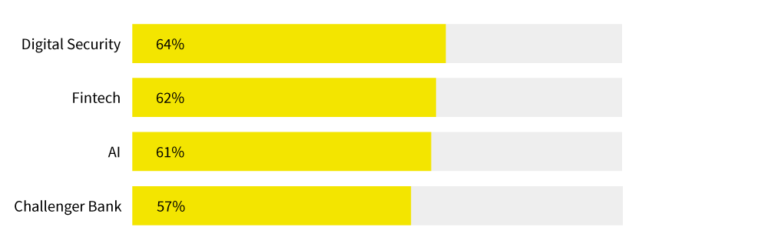

Over the last few years, we’ve started to see a levelling out across sectors of the proportion of deals that go unannounced, but there are still slight differences between them.

Given its innate secrecy, it’s unsurprising that digital security tops the list of sectors with the highest proportion of unannounced deals. During 2020, however, just 50% of digital security rounds were unannounced, perhaps due to it being a maturing sector with more late-stage companies—not to mention the huge spotlight that the pandemic put on cybersecurity, making it more appealing for these companies to announce any investment.

The most popular sectors in the UK—fintech and artificial intelligence—take a middling position in the rankings, with challenger banks appearing as the most vocal about their funding rounds. We expect this is because challenger banks are endeavouring to be more transparent with their customers than industry incumbents, and are hence more open about their shareholders and fundraisings. Many have also drawn on crowdfunding (which is always announced to the public).

Percentage of deals that are unannounced by selected sectors

Investment sizes

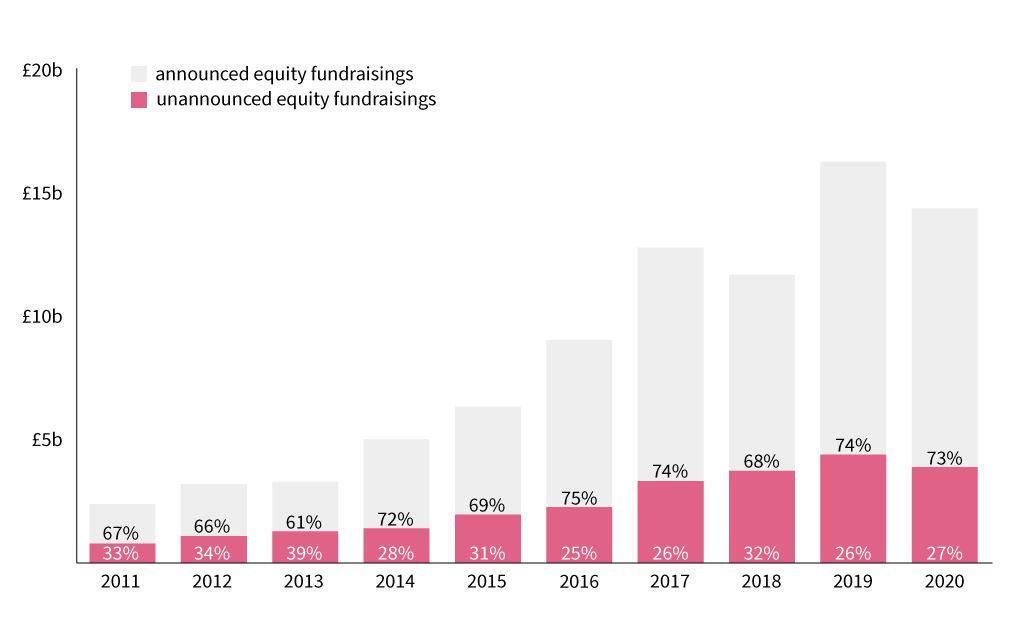

On average, unannounced fundraisings are significantly smaller in value than those that are announced. Though the precise proportion of pounds invested that are unannounced fluctuates each year, the figure has never risen above 40%.

total Amount raised and percent unannounced

Despite the fact that they are often small in value, these types of transactions form an incredibly important and significant portion of the transactions in the UK’s high-growth economy.

Keeping an eye on these rounds can be invaluable to any business working to find and back the next billion-dollar startup, or to support private companies through an IPO or financial difficulty. You can get access to all of this data with a subscription to the Beauhurst platform.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.